China launched an innovative program of catastrophic medical insurance (CMI) to protect households from catastrophic health expenditure (CHE) and impoverishment. This article assesses the effect of CMI on relieving CHE and impoverishment from catastrophic illnesses in urban and rural China.

MethodIn total, 8378 cases are included in the analysis. We employed descriptive statistical analysis to compare the incidence and intensity of CHE at five health expenditure levels, from 1 June 2014 to 31 May 2015. To illustrate the different protection of the policy, we analyzed the data in two lines, the covered medical expenses and the total medical expenses.

ResultsCMI drop down CHE incidence from 4.8% to 0.1% and the mean catastrophic payment gap from 7.9% to zero when only considering covered medical expenses. CMI drop down CHE incidence from 15.5% to 7.9% and the mean catastrophic payment gap from 31.2% to 14.7% when considering total medical expenses. If CMI reimburse uncovered medical expenses at 30%, the mean catastrophic payment gap could be 7.9% and insured person's annual premium will increase US$2.19.

ConclusionsChina CMI perfectly meet the pursued policy objectives when only considering the covered medical expenses. However, when considering the total medical expenses, the CMI is only partially effective in protecting households from CHE. The considerable gap is the result of the limitation of CMI list.

China lanzó un innovador programa de Seguro Catastrófico de Salud (SCS) para proteger a los hogares del gasto sanitario catastrófico (GSC) y el empobrecimiento. Este artículo evalúa el efecto del SCS para aliviar el GSC y el empobrecimiento a causa de las enfermedades catastróficas en zonas urbanas y rurales de China.

MétodoEn total, se incluyen 8378 casos en el análisis. Se emplearon análisis estadísticos descriptivos para comparar la incidencia y la intensidad del GSC en cinco niveles de gastos de salud, del 1 de junio de 2014 al 31 de mayo de 2015. Para ilustrar la diferente protección de la política se analizaron los datos en dos líneas: los gastos sanitarios cubiertos por el seguro y los gastos sanitarios totales.

ResultadosConsiderando los gastos cubiertos por el seguro, se redujeron los hogares con gastos catastróficos del 4,8% al 0,1%, y la brecha de pago catastrófico media cayó del 7,9% al 0,0% en promedio. Cuando consideramos el gasto sanitario total, los hogares con gasto catastrófico se redujeron del 15,5% al 7,9%, y la brecha de pago catastrófico media cayó del 31,2% al 14,7% en promedio. Esta cantidad podría reducirse al 7,9% si se reembolsara el 30% a los gastos no cubiertos por el SCS, lo que supondría un aumento de la prima del seguro por persona de US$ 2,19.

ConclusionesEl SCS de China cumple perfectamente los objetivos de la política perseguida cuando solo se consideran los gastos cubiertos por el seguro. Si se consideran los gastos totales, el SCS solo es parcialmente efectivo para proteger a los hogares del gasto sanitario catastrófico. El motivo de este desfase es la limitación existente en la lista de servicios cubiertos por el SCS.

A recent study on catastrophic medical insurance (CMI) in China notes that an innovative policy design by the Chinese government aimed at relieving the financial burden on people who suffer a critical illness is receiving international attention.1 The burden brought on by critical illness is higher than generally appreciated, and will only increase as the population ages. Critical illnesses caused 36.19 million deaths and 662.71 million years of life lost worldwide in 2016, both figures experiencing a growth of 18.6% to 51.4% from 2006 to 2016, respectively.2 Highly regressive payments cause financial hardship at all income levels, especially in low- and middle-income countries, i.e. financial catastrophe for about 150 million people worldwide pushed 100 million people into poverty in 2015.3 Expenditure for diagnosis and treatment seemed catastrophic for patients with cancer in China.4 Reducing out-of-pocket (OOP) health expenses is an important public health issue, in which social as well as medical determinants should be prioritized. Enhanced provision of publicly funded insurance helps to protect people against catastrophic health expenditure (CHE) and health-care inequity.5

Protection against financial risk is an explicit health guarantee within China's health reform. In 2012, China's central government launched a CMI program. CMI was the design that reimburse patients whose out of pocket medical expenses exceeding a certain level after reimbursed by the basic medical insurance (BMI) system, with the aim of preventing people from being reduced to poverty by necessary health-care costs.6 The CMI revenue comes from BMI revenue, usually occupying its 5%, or a certain annual premium amount from US$ 3.25 to US$ 8.14 in different provinces. BMI only covers necessary treatment and medicine, not including organ transplant and following up antirejection treatment, tumor immunotherapy and most targeted therapy and other expensive therapies (see Table I in Appendix online). CMI reimbursement scope follows that of BMI. Although around 1.3 billion people have been covered by the BMI system in 2016,7 medical expenditure burdens incurred by patients with severe medical conditions remain heavy. BMI system mainly comprises urban employees’ BMI, urban resident BMI, and the new rural cooperative medical system. High OOP costs resulting from catastrophic illnesses are often financially devastating and can plunge families into poverty. The new arrangement will increase the level of protection provided by China's BMI system.

China's CMI program aims to ensure that each patient's total medical expenditure is no more than the “catastrophic household expenditure for healthcare”.8 The World Health Organization proposes that health expenditure should be called catastrophic whenever it is greater than or equal to 40% of the disposable income.9,10 However, individual countries could well adopt a higher or lower percentage in their respective national health policies.11 The Chinese State Public Health and Family Planning Commission suggested setting the households CHE level at the regional annual per capita disposable or net income.8 Patients receive reimbursements from the newly launched CMI scheme when their medical bills for necessary treatments under the existing basic healthcare insurance system exceed a certain level. It is not a percentage; it is a certain amount, such as US$ 813.96 in Qinghai province, or US$ 1302.34 in Hubei province. It should be noted that there is a distinct difference between the definition of a critical illness in China's CMI scheme and the traditional definition of diagnosed diseases.12,13 In the CMI scheme, a critical illness is determined by the patient's OOP expenses after receiving reimbursement from China's BMI system, irrespective the kind of disease diagnosed. Eighty percent of covered medical expenses exceeding US$ 813.96 paid by patients after reimbursed by BMI system will be reimbursed by the CMI to reduce the burden on such patients.

Epidemics of chronic diseases, are becoming the main cause of CHE, and will rise in the future.14,15 China's new approach targets the widely acknowledged problem of “people falling into poverty due to illnesses”, and aims to ensure that most people are not reduced to poverty because of health-related issues. All local governments have been asked to develop local regulations regarding fund raising, reimbursement levels and other details regarding the new insurance scheme in line with local conditions.6

Qinghai Province, district selected by our study, is an agricultural hinterland in China's northwest, located in the northeast of the Qinghai-Tibet Plateau, which is known as the “Roof of the World”, and was once a part of the ancient Silk Road. People living in this region have a poor level of health, and despite a decade of health promotion and disease prevention program, there are significant health disparities among the western, central and eastern regions of China. The average life expectancy in Qinghai is 68.1, far below that in Shanghai (81.1 years in 2016).16 Qinghai is one of the poorest zones in China, and the government is attempting to alleviate poverty in the region. Medical costs resulting from critical illnesses are an important cause of poverty. The per capita disposable income, personal income after taxes, in Qinghai was US$ 2816.63 in 2016, which includes US$ 581.98 paid by central government.17 The level of social economic development was not necessarily associated with total medical expenses but determined the level of financial protection.18 Preventing people with catastrophic illness from falling into poverty is a matter of prime significance in this zone compared with other provinces.

Although a few studies have examined the program policy design1,6,8,19, there has been no appraisal since the program was launched in 2013. Whether the China CMI reaches the original target, how much the program reduces the incidence of the urban and rural residents CHE, how should the program be optimized, are all questions that have not been well answered. This study addresses these issues.

MethodsStudy designWe provide an overview of the CMI program design and the development of the CMI scheme in the Xining, Hainan, Huangnan, and Guoluo regions within Qinghai Province from the launch of the program to the present day. The China Life Insurance Company undertakes the system in the four regions. We observe changes in the disease financing burden for residents with catastrophic illnesses before and after CMI reimbursement. Our study period is the year from 1 June 2014 to 31 May 2015. Our attention is mainly focused on the percentage of payments and the incidence and intensity of CHE before and after the CMI reimbursement, within the covered medical expenses and the total medical expenses. To illustrate the impacts on patients with different medical expenditure, we divided them into 5 groups by their total medical expenditure.

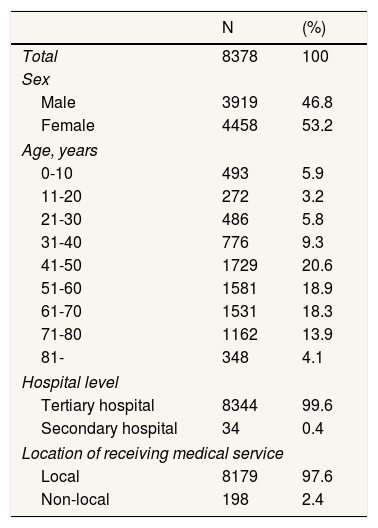

DataThis study uses data for the period 2013-2015 obtained from the medical insurance management system of Qinghai Province. A brief overview of the CMI program includes the number of urban and rural residents insured under the CMI scheme, fund revenue, fund expenditure, and fund balances. All the medical services records are retrievable for the purposes of the study. These records include covered and uncovered medical expenses, payments by the BMI and CMI schemes, the extent of the medical services received, sex, and age (Table 1).

Characteristics of beneficiaries from catastrophic medical insurance in 2014-2015.

| N | (%) | |

|---|---|---|

| Total | 8378 | 100 |

| Sex | ||

| Male | 3919 | 46.8 |

| Female | 4458 | 53.2 |

| Age, years | ||

| 0-10 | 493 | 5.9 |

| 11-20 | 272 | 3.2 |

| 21-30 | 486 | 5.8 |

| 31-40 | 776 | 9.3 |

| 41-50 | 1729 | 20.6 |

| 51-60 | 1581 | 18.9 |

| 61-70 | 1531 | 18.3 |

| 71-80 | 1162 | 13.9 |

| 81- | 348 | 4.1 |

| Hospital level | ||

| Tertiary hospital | 8344 | 99.6 |

| Secondary hospital | 34 | 0.4 |

| Location of receiving medical service | ||

| Local | 8179 | 97.6 |

| Non-local | 198 | 2.4 |

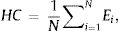

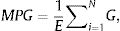

CHE is usually assessed in terms of incidence and intensity. Headcount (HC) is used to measure incidence, while mean gap (MG) and mean positive gap (MPG) are used to measure intensity. HC means the percentage of households whose OOP payments as a proportion of their income, equal or exceed a threshold. In this study, total OOP payments equaling or exceeding 40% of the disposable income is regarded as catastrophic. HC is estimated as follows:

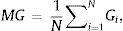

where N is the sample size and E is an indicator equal to 1 if the OOP expenses of a household as a proportion of its disposable income are greater than 40% and zero otherwise. MG is the average amount by which payments, as a proportion of income, equal or exceed 40% of disposable income and is estimated as follows:

where N is the sample size and G is an indication by how much OOP payments exceed the threshold, which is equal to TiXi−40%, if TiXi > 40% and zero otherwise. Here, Ti is the OOP payments of household i, Xi is household i's disposable income. Finally,

where E is the size of the households which OOP payments to the disposable income is greater than 40%.20

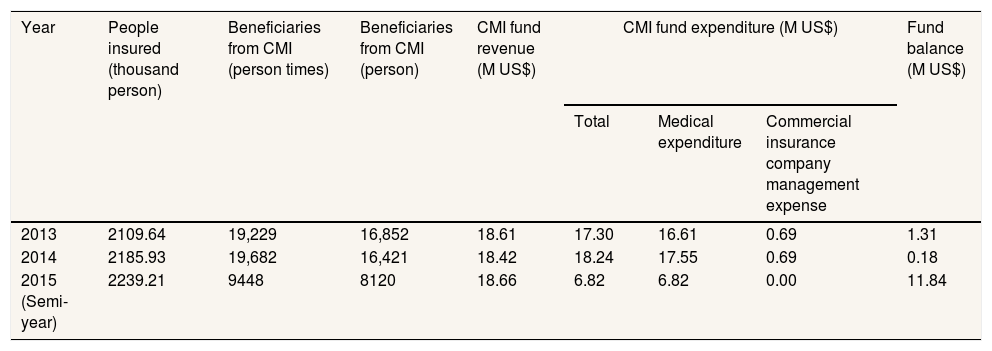

ResultsProgram design and a general summary of CMI in the four regionsAll the people insured under the BMI scheme is automatically insured under the CMI scheme. By the end of 2015, the number of people insured under the CMI scheme reached 2,239.21 thousand. Every insured person's US$ 8.14 annual premium will be taken from the BMI system for CMI from 2013. Table 2 shows the summary of CMI fund operation. Insured people mean all persons insured by the CMI program; beneficiaries mean all persons received reimbursement from the CMI program.

Brief overview of catastrophic medical insurance in Qinghai province.

| Year | People insured (thousand person) | Beneficiaries from CMI (person times) | Beneficiaries from CMI (person) | CMI fund revenue (M US$) | CMI fund expenditure (M US$) | Fund balance (M US$) | ||

|---|---|---|---|---|---|---|---|---|

| Total | Medical expenditure | Commercial insurance company management expense | ||||||

| 2013 | 2109.64 | 19,229 | 16,852 | 18.61 | 17.30 | 16.61 | 0.69 | 1.31 |

| 2014 | 2185.93 | 19,682 | 16,421 | 18.42 | 18.24 | 17.55 | 0.69 | 0.18 |

| 2015 (Semi-year) | 2239.21 | 9448 | 8120 | 18.66 | 6.82 | 6.82 | 0.00 | 11.84 |

CMI: catastrophic medical insurance; M US$: millions of US dollars.

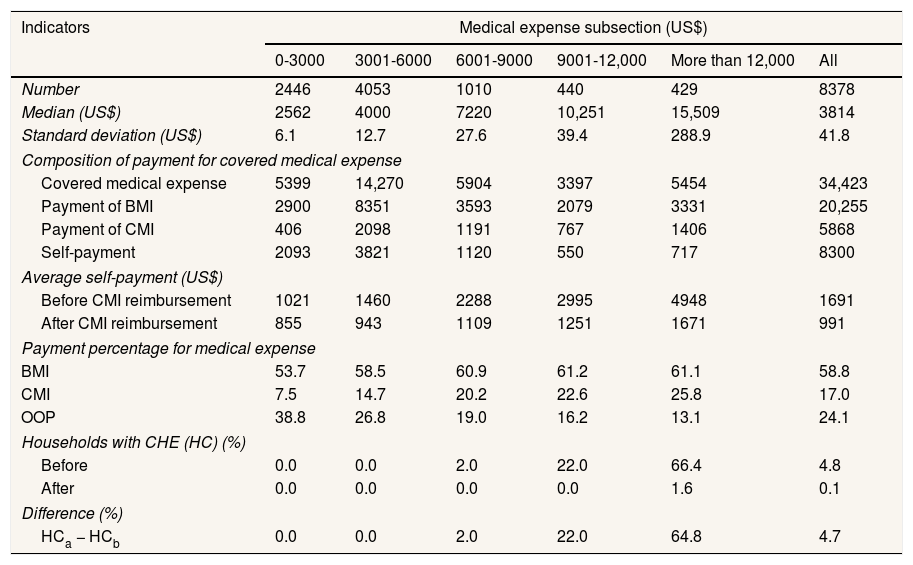

China's medical insurance administration sets a state medicine catalogue for BMI, which also guides the CMI scheme. Uncovered medical expenses will not be reimbursed by any insurance system. So, there is a considerable difference between covered medical expenses and total medical expenses in its reimbursement rate and self-payment. We analyzed on the covered medical expenses first (Table 3).

Catastrophic medical insurance impact on incidence of catastrophic health expenditure considering covered medical expenses.

| Indicators | Medical expense subsection (US$) | |||||

|---|---|---|---|---|---|---|

| 0-3000 | 3001-6000 | 6001-9000 | 9001-12,000 | More than 12,000 | All | |

| Number | 2446 | 4053 | 1010 | 440 | 429 | 8378 |

| Median (US$) | 2562 | 4000 | 7220 | 10,251 | 15,509 | 3814 |

| Standard deviation (US$) | 6.1 | 12.7 | 27.6 | 39.4 | 288.9 | 41.8 |

| Composition of payment for covered medical expense | ||||||

| Covered medical expense | 5399 | 14,270 | 5904 | 3397 | 5454 | 34,423 |

| Payment of BMI | 2900 | 8351 | 3593 | 2079 | 3331 | 20,255 |

| Payment of CMI | 406 | 2098 | 1191 | 767 | 1406 | 5868 |

| Self-payment | 2093 | 3821 | 1120 | 550 | 717 | 8300 |

| Average self-payment (US$) | ||||||

| Before CMI reimbursement | 1021 | 1460 | 2288 | 2995 | 4948 | 1691 |

| After CMI reimbursement | 855 | 943 | 1109 | 1251 | 1671 | 991 |

| Payment percentage for medical expense | ||||||

| BMI | 53.7 | 58.5 | 60.9 | 61.2 | 61.1 | 58.8 |

| CMI | 7.5 | 14.7 | 20.2 | 22.6 | 25.8 | 17.0 |

| OOP | 38.8 | 26.8 | 19.0 | 16.2 | 13.1 | 24.1 |

| Households with CHE (HC) (%) | ||||||

| Before | 0.0 | 0.0 | 2.0 | 22.0 | 66.4 | 4.8 |

| After | 0.0 | 0.0 | 0.0 | 0.0 | 1.6 | 0.1 |

| Difference (%) | ||||||

| HCa − HCb | 0.0 | 0.0 | 2.0 | 22.0 | 64.8 | 4.7 |

BMI: basic medical insurance; CHE: catastrophic health expenditure; CMI: catastrophic medical insurance; HC: headcount; K US$: thousands of US dollars; OOP: out-of-pocket.

When we focus on the reimbursement rates of the different insurance systems, we find that BMI pays 58.8% of the medical expenses, the CMI scheme pays 17.0% and the patient pays the other 24.1%. There has been a sustained increase in the percentage paid by the CMI scheme, which is 7.5% in the US$ 0-3000 group and 25.8% in the more than US$ 12,000 group. Simultaneously the percentage of OOP expenses decreased from 38.8% to 13.1%. The average self-payment before and after CMI reimbursement is US$ 1,021 to US$ 855 in the US$ 0-3000 group, and from US$ 4948 to US$ 1671 in the more than US$ 12,000 group. There is apparently a progressive compensation in the CMI. Table 3 shows that 4.8% of patients experience CHE before CMI reimbursement. After reimbursement, this falls to 0.1%. In more than US$ 12,000 group, the number of patients experiencing CHE falls from 66.4% to 1.6%.

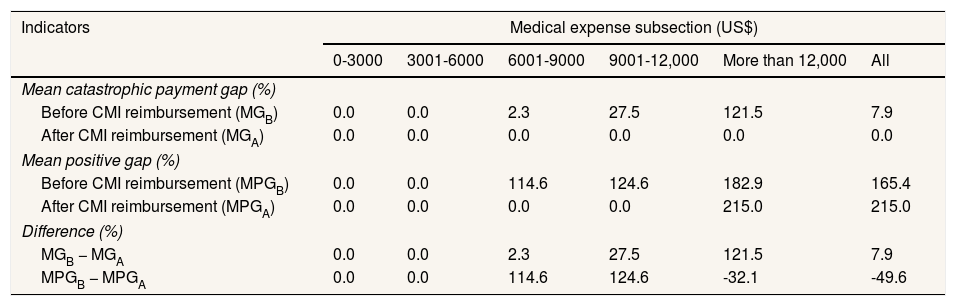

The MG for the more than US$ 12,000 group reached 121.5%, but after CMI reimbursement it fell to almost zero in all cost groups. The MPG also fell to zero if the cost was below US$ 12,000, but in the more than US$ 12,000 group, owing to the incidence number of CHE as a denominator dramatically decreased from 285 to 7, it rose from 182.9% to 215.0% on the contrary (Table 4).

Catastrophic medical insurance impact on intensity of catastrophic health expenditure considering covered medical expenses.

| Indicators | Medical expense subsection (US$) | |||||

|---|---|---|---|---|---|---|

| 0-3000 | 3001-6000 | 6001-9000 | 9001-12,000 | More than 12,000 | All | |

| Mean catastrophic payment gap (%) | ||||||

| Before CMI reimbursement (MGB) | 0.0 | 0.0 | 2.3 | 27.5 | 121.5 | 7.9 |

| After CMI reimbursement (MGA) | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Mean positive gap (%) | ||||||

| Before CMI reimbursement (MPGB) | 0.0 | 0.0 | 114.6 | 124.6 | 182.9 | 165.4 |

| After CMI reimbursement (MPGA) | 0.0 | 0.0 | 0.0 | 0.0 | 215.0 | 215.0 |

| Difference (%) | ||||||

| MGB − MGA | 0.0 | 0.0 | 2.3 | 27.5 | 121.5 | 7.9 |

| MPGB − MPGA | 0.0 | 0.0 | 114.6 | 124.6 | -32.1 | -49.6 |

CMI: catastrophic medical insurance; MG: mean gap; MPG: mean positive gap.

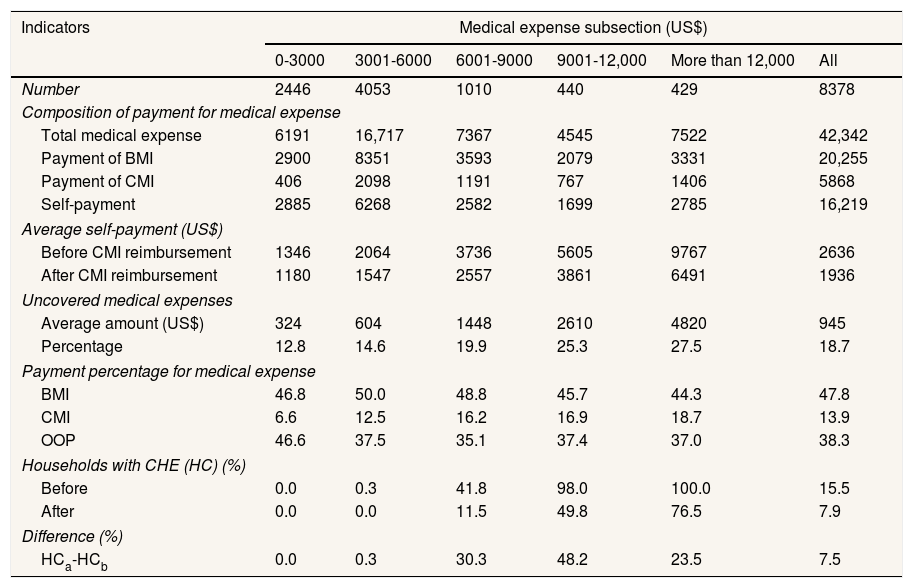

Uncovered medical expenses are not reimbursed by BMI or the CMI system. Average uncovered medical expenses ranges from 12.8% to 27.5%, with the more than US$ 12,000 group incurring higher. As a result, the average percentage of payment of BMI is 47.8%, and the percentage of payment of CMI is 13.9%, varying from 6.6% to 18.7% for the different cost groups, even though the average OOP expenses fall from US$ 9767 to US$ 6491 in the more than US$ 12,000 group after CMI reimbursement. Almost all the patients in the high cost group experience CHE prior to CMI reimbursement. After reimbursement, this falls to 49.8% and 76,5% for the US$ 9001-12,000 and the more than US$ 12,000 groups, respectively. The incidence of CHE decreased from 15.50% to 7.90% after CMI reimbursement in Qinghai province in 2015. We further distinguish the different reduce range at the different medical cost level. The incidences of CHE respective drop at a rate of 100.0%, 100.0%, 72.5%, 49.2%, 23.5% from lowest to highest medical cost level, at an average rate of 48.4% (Table 5).

Catastrophic medical insurance impact on incidence of catastrophic health expenditure considering total medical expenses.

| Indicators | Medical expense subsection (US$) | |||||

|---|---|---|---|---|---|---|

| 0-3000 | 3001-6000 | 6001-9000 | 9001-12,000 | More than 12,000 | All | |

| Number | 2446 | 4053 | 1010 | 440 | 429 | 8378 |

| Composition of payment for medical expense | ||||||

| Total medical expense | 6191 | 16,717 | 7367 | 4545 | 7522 | 42,342 |

| Payment of BMI | 2900 | 8351 | 3593 | 2079 | 3331 | 20,255 |

| Payment of CMI | 406 | 2098 | 1191 | 767 | 1406 | 5868 |

| Self-payment | 2885 | 6268 | 2582 | 1699 | 2785 | 16,219 |

| Average self-payment (US$) | ||||||

| Before CMI reimbursement | 1346 | 2064 | 3736 | 5605 | 9767 | 2636 |

| After CMI reimbursement | 1180 | 1547 | 2557 | 3861 | 6491 | 1936 |

| Uncovered medical expenses | ||||||

| Average amount (US$) | 324 | 604 | 1448 | 2610 | 4820 | 945 |

| Percentage | 12.8 | 14.6 | 19.9 | 25.3 | 27.5 | 18.7 |

| Payment percentage for medical expense | ||||||

| BMI | 46.8 | 50.0 | 48.8 | 45.7 | 44.3 | 47.8 |

| CMI | 6.6 | 12.5 | 16.2 | 16.9 | 18.7 | 13.9 |

| OOP | 46.6 | 37.5 | 35.1 | 37.4 | 37.0 | 38.3 |

| Households with CHE (HC) (%) | ||||||

| Before | 0.0 | 0.3 | 41.8 | 98.0 | 100.0 | 15.5 |

| After | 0.0 | 0.0 | 11.5 | 49.8 | 76.5 | 7.9 |

| Difference (%) | ||||||

| HCa-HCb | 0.0 | 0.3 | 30.3 | 48.2 | 23.5 | 7.5 |

BMI: basic medical insurance; CHE: catastrophic health expenditure; CMI: catastrophic medical insurance; HC: headcount; OOP: out-of-pocket.

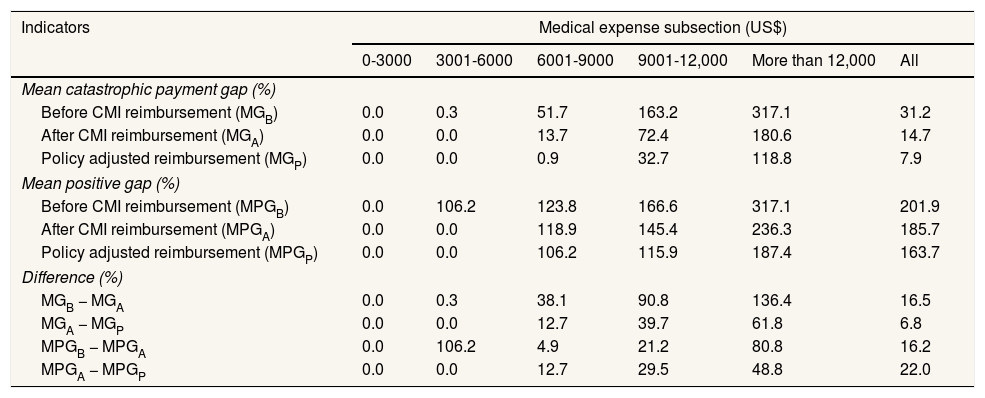

Table 6 shows the effect of CMI on CHE intensity. Before reimbursement, the MG and MPG are 31.2% and 201.9%, respectively. After reimbursement, they fall to 14.7% and 185.7%, respectively. If an adjustment is made to the current CMI reimbursement policy, for example we reimburse 30% for the uncovered medical service at now, the MG and MPG could further decrease to 7.9% and 163.7%, respectively. Correspondingly, the CMI fund expenditure will increase US$ 489.79 thousands; premium will increase US$ 2.19, which paid by government and insured persons commonly. Certainly, higher reimbursement may bring out more frequently use of medical services21.

Catastrophic medical insurance impact on intensity of catastrophic health expenditure considering total medical expenses.

| Indicators | Medical expense subsection (US$) | |||||

|---|---|---|---|---|---|---|

| 0-3000 | 3001-6000 | 6001-9000 | 9001-12,000 | More than 12,000 | All | |

| Mean catastrophic payment gap (%) | ||||||

| Before CMI reimbursement (MGB) | 0.0 | 0.3 | 51.7 | 163.2 | 317.1 | 31.2 |

| After CMI reimbursement (MGA) | 0.0 | 0.0 | 13.7 | 72.4 | 180.6 | 14.7 |

| Policy adjusted reimbursement (MGP) | 0.0 | 0.0 | 0.9 | 32.7 | 118.8 | 7.9 |

| Mean positive gap (%) | ||||||

| Before CMI reimbursement (MPGB) | 0.0 | 106.2 | 123.8 | 166.6 | 317.1 | 201.9 |

| After CMI reimbursement (MPGA) | 0.0 | 0.0 | 118.9 | 145.4 | 236.3 | 185.7 |

| Policy adjusted reimbursement (MPGP) | 0.0 | 0.0 | 106.2 | 115.9 | 187.4 | 163.7 |

| Difference (%) | ||||||

| MGB − MGA | 0.0 | 0.3 | 38.1 | 90.8 | 136.4 | 16.5 |

| MGA − MGP | 0.0 | 0.0 | 12.7 | 39.7 | 61.8 | 6.8 |

| MPGB − MPGA | 0.0 | 106.2 | 4.9 | 21.2 | 80.8 | 16.2 |

| MPGA − MPGP | 0.0 | 0.0 | 12.7 | 29.5 | 48.8 | 22.0 |

CMI: catastrophic medical insurance; MG: mean gap; MPG: mean positive gap.

We analyzed the incidence and intensity of CHE before and after CMI imbursement in five level medical expenses and in two lines. CMI shows a desired effect on covered medical expenses and a lower-than-expected effect on total medical expenses. The finding shows that a combination of CMI and BMI could provide perfect financial protection against covered medical expenses. CMI can significantly improve the level of financial protection for residents, while the financial protection provided by BMI is limited. The CMI scheme demonstrates strong equity with progressive compensation. The incidence of CHE is almost eliminated in all the expense groups, while at the same time, the intensity of CHE at all health expense levels falls to zero unless the MPG in the more than US$ 12,000 group.

The findings also show that a combination of CMI and BMI can only provide partial financial protection against the total medical expenses. CMI can at a certain extent improve financial protection. The CMI reimbursement also presents progressive compensation. Findings from previous studies indicated that the incidence of CHE decreased from 13.62% to 7.74% after New Cooperative Medical Scheme reimbursement in Jiangsu Province in 2010.22 The sharp declines of the incidence of CHE in all the expense levels in our study demonstrate a strong financial protection of CMI.

We find that uncovered medical expenses is the main reason for the significant difference in the financial protection effect of CMI between the two situations. Uncovered medical expenses rise from 12.8% to 27.5% as total medical costs increase. According to Pavón-León et al.24 study on OOP health expenses incurred by elderly people enrolled in the Seguro Popular program23 in Mexico, the percent of the drugs that are not covered by the program to the monthly OOP expenditure on health is 12.35%. This part of the medical expenses was ignored and not reimbursed by either BMI or CMI because the CMI scheme follows the reimbursement list of the BMI scheme. Another fact may furnish the evidence that the BMI reimbursement rate assumes progressive in the covered medical cost but presents regressive in the total medical cost. The significant gap is the result of the limitations of the CMI list. Innovative drugs are often unavailable through the National or local Essential Drugs List in China, so patients must cover the full cost of these expensive drugs. They suggest treatment access for patients needs to be improved through better drug availability.25 We also propose broadening the CMI list based on treatment needs in relation to catastrophic illness and pharmacoeconomics evaluation.

Honestly, we chose Qinghai Province because it may produce most demonstrable effect. Though all the provinces have the same policy design, Qinghai executed lowest deductible and co-insurance for covered health care services. Other provinces may not demonstrate so obvious protective effect. On the other hand, it proves that the policy can meet its policy objectives if it has enough low deductible and co-insurance.

In terms of objective and program design, China CMI program and Mexico Seguro Popular can be compared. While 10% of BMI fund was appropriated as the CMI fund in Qinghai province, the system of Mexico Social Protection in Health allocated 8% of all resources to Seguro Popular annually to cover costly, specialized interventions for protection against CHE. Correspondingly, the incidence of CHE drops 49.03% in Qinghai province, while it drops 10.0% when people with social security and 20.6% when people without social security in Mexico.26 In this respect, CMI in Qinghai shows more effective than Seguro Popular. We also think it has some advantage that the definition of critical illness defined by the expense and not by the diseases diagnosed in China CMI. Insured people suffering from rare diseases have no any obstacle to benefiting from the program. The policy implication may enlighten other countries reform and development against CHE.

Though our study has some interesting findings, it also has some limitation. We collect medical expense of every patient reimbursed by CMI in the year as his/her direct medical cost, not including non-medical cost such as the transport and accommodation costs for patients and companions, and nutrition supplements costs. According to a study on the component of OOP of patients with tuberculosis as one of the critical illness, the direct health expenditure for tuberculosis care is the most important component of the OOP, accounting for over 72% of the total OOP payments, following by transport and accommodation costs for patients and companions (13.3%), and nutrition supplements cost (13.1%).20 That consistent with another study which shows chronic diseases, needing not only hospitalization service but also ambulatory care and drugs, are responsible for 68.8% of the total disease burden in China.27 That would also probably lead to an underestimation of incidence and intensity of CHE. Due to imperfect income registration system in China, we cannot get the completely household income of the patients and their families, so we cannot calculate out every patients’ household CHE incidence criteria. We adopt the China health and family planning commission's recommendation on incidence of CHE about catastrophic illness financial protection. That is a stationary line not varying with everyone. Despite these limitations, the findings of this study would offer an insight into the effect of BMI and CMI on protection from CHE, considering we adopt the same criteria to evaluate the effect.

This study finds that CMI has had a significant effect in terms of protecting households from CHE if we focus only on the covered medical expenses, and a combination of CMI and BMI can provide financial protecting to people who experience a catastrophic illness. But if we consider total medical expenses, CMI can only provide limited protection from CHE. The considerable gap that remains is the result of the limitations of the CMI list, which currently corresponds with the BMI list. We propose broadening the CMI list based on treatment needs in relation to catastrophic illness and pharmacoeconomics evaluation.

China government launched an innovative policy catastrophic medical insurance in 2013 to prevent people from catastrophic health expenditure. The program has covered 1.3 billion people in 2016 and got some international concern on its policy design and its effect.

What does this study add to the literature?Our study, the first evaluate of the effect of China catastrophic medical insurance, set the reduce of the incidence and intensity of catastrophic health expenditure as key indicators. China catastrophic medical insurance program may inspire other regions

Miguel Ángel Negrín Hernández.

Transparency declarationThe corresponding author on behalf of the other authors guarantee the accuracy, transparency and honesty of the data and information contained in the study, that no relevant information has been omitted and that all discrepancies between authors have been adequately resolved and described.

Authorship contributionsP. Fang designed the study. S. Zhao conducted data collection, the analyses, interpreted the results, and drafted the manuscript. X. Zhang contributed to the data collection and interpretation of the results. W. Dai, Y. Ding and J. Chen collaborated in the data analysis and interpretation of the results. All authors critically reviewed the manuscript and approved the final version submitted for publication.

AcknowledgementsWe express our gratitude to Mr. Huabo Huang, the vice director of National Social Insurance Management Center of China and the Medical Insurance Management Bureau of Qinghai Province for their support.

FundingThis work was supported by the National Natural Science Foundation of China (NSFC) [No. 71333005], the National Philosophy and Social Science Foundation (NPSSF) of China [No. 15ZDC037].

Conflicts of interestNone.