Philip Morris International, has already introduced its heated tobacco product, IQOS, in many countries and marketed it on the grounds that it is a less harmful alternative to health. The company claims that its intention is for its brand's traditional cigarette smokers to replace these with IQOS has rarely been independently tested.

MethodUsing time series data from September 2016 to June 2020, we analyze whether Heets sales have been accompanied by an improvement in the position of Philip Morris International in the market or if they have merely replaced lost sales of the rest of the brands sold by that tobacco company.

ResultsSales of traditional cigarettes of all the brands marketed by PMI have been replaced by IQOS since the introduction of this heated tobacco product in Spain. Almost all of the variations observed in IQOS sales are due to the positioning of this product as a substitute for the range of traditional cigarettes marketed by Philip Morris International.

ConclusionsAs there is still no consensus that HTPs are explicitly less harmful to health, health authorities must control messages suggesting improved health outcomes thanks to HTP usage when compared to traditional cigarettes. Such messages could generate a false sense of security and lead to an increase in the consumption of tobacco. In Spain Heets in a category that has a lower tax burden than the category of traditional cigarettes. Tax authorities must consider this migration and the impact this may have on tax collection.

Philip Morris International ha introducido en muchos países su producto de tabaco calentado, IQOS, y lo ha comercializado con el argumento de que es una alternativa menos dañina para la salud. La compañía afirma que su intención es que los fumadores de cigarrillos tradicionales de su marca los reemplacen con IQOS.

MétodoUtilizando datos de series temporales de septiembre de 2016 a junio de 2020, analizamos si las ventas de Heets han ido acompañadas de una mejora en la posición de Philip Morris International en el mercado o si simplemente han sustituido a las ventas perdidas del resto de las marcas vendidas por esa compañía tabaquera.

ResultadosLas ventas de cigarrillos tradicionales de todas las marcas comercializadas por Philip Morris International han sido sustituidas por IQOS desde la introducción de este producto de tabaco calentado en España. Casi todas las variaciones observadas en las ventas de IQOS se deben al posicionamiento de este producto como sustituto de la gama de cigarrillos tradicionales que comercializa Philip Morris International.

ConclusionesComo todavía no existe consenso en cuanto a que los HTP sean explícitamente menos dañinos para la salud, las autoridades sanitarias deben controlar los mensajes que sugieran mejores resultados en la salud gracias al uso de HTP en comparación con los cigarrillos tradicionales. En España se encuentran en una categoría que tiene una carga fiscal más baja que la de los cigarrillos tradicionales. Las autoridades fiscales deben considerar esta migración y el impacto que puede tener en la recaudación fiscal.

In some countries, the introduction of novel tobacco products is significantly changing the composition of the tobacco market.1 Manufacturers of tobacco products indicate that the novelties introduced in the tobacco market are related to the development of alternatives that are less harmful to public health. However, the evaluation of the public health impact of these novel products cannot be reliably determined in short periods of time. Although some articles observe changes in the prevalence of different types of products,2,3 there are still few studies that analyse how the introduction of novel products influences the sales of the main product in the tobacco market, cigarettes.

Although there are other new tobacco products, heated tobacco products (HTP) are one of the latest trends in the marketing of alternatives to cigarettes which are claimed to be less harmful to health. The fundamental novelty consists in not burning the cigarette at a high temperature, but in heating it to a temperature that allows the inhalation of nicotine. What marks the difference with electronic cigarettes and vaping products is that in HTPs the nicotine is released directly from the tobacco leaf, while in vaping products a liquid containing processed nicotine is aerosolized. There is a growing trend of consumption of this type of product in many countries.4–6 Specifically, since the first quarter of 2019, HTPs have been present in more than 40 countries.7,8 This presence is especially important in Asian countries9,10 where, in some cases like Japan, the introduction of HTPs has generated a significant drop in cigarette sales.1 Internationally, Philip Morris International (PMI) is the leader in the HTP market, although other companies such as British American Tobacco11 and Japan Tobacco International have also developed HTP products. All these tobacco companies, especially PMI, publicly promote the notion that the use of HTPs generates health benefits for smokers by avoiding combustion.12–14 This is still under debate from an academic point of view, although PMI's confidence in HTPs is very high. As a specific example of this, in New Zealand, PMI has announced that its forecast is to stop selling cigarettes to sell only its alternative HTPs, IQOS.15 This claim is also being challenged by the academic literature on HTPs.

PMI has considered displacing traditional cigarettes with its HTP alternative. IQOS is PMI's HTP alternative and in some statements the tobacco company has stated that IQOS is the only alternative for those adult smokers who abandon traditional cigarettes.16,17 In addition, the aforementioned tobacco company has also publicly shown that it wants the millions of adult smokers that exist to make the transition to less harmful products such as IQOS as soon as possible.17–19 In addition, PMI has also made it public that it wants smokers of its brand's cigarettes to use heated tobacco. That is the reason why this paper fundamentally discusses the Heets replacement of PMI cigarettes. On many occasions PMI has boasted that the introduction and growth of IQOS leads to a decrease in cigarette sales. This claim, although in Japan there is evidence that it has been fulfilled,1 is still under debate, given that the market share of IQOS is still very small in many countries. This is the case in Spain, a country in which, since its introduction in September 2016, PMI's HTP alternative has only been able to reach a market share of 1%.

In Spain, PMI has marketed IQOS heating cigarettes under a single brand called Heets. Heets does not have a large market share in Spain. However, it could be the case that Heets was a strategy to increase total market share from PMI, rather than an intention to replace the traditional cigarette with a less harmful alternative. This study analyzes whether the introduction of IQOS in Spain has replaced part of PMI's cigarette sales or, on the contrary, it is a strategy to improve the company's position in the market. For this, three Logarithmic Mean Divisa Index (LMDI) decompositions are used with data from the introduction of IQOS in Spain (September 2016): a decomposition that considers the effect of population and economic growth, another that takes into account the evolution of the market of Spanish cigarettes and another that takes into account the evolution of PMI's position in the market. This is a debate that has already been initiated by academics who conclude that restrictions on use, advertising and taxation of heated tobacco products should be equated with that of traditional cigarettes.20

To motivate the study in Spain is useful for two reasons. First, we consider it necessary to begin empirical evidence on the migration of smokers from traditional cigarettes to heated tobacco products. After the work that opens the debate in Spain20 there is no evidence on the consumption of heated tobacco products in Spain. Second, a recent paper21 indicates that the smoking population in Spain has decreased during the 2009-2017 period. This seems motivated by the perception that tobacco use is an unhealthy habit. If the entry into the market of heated tobacco products leads to a migration of cigarette users to heated tobacco products, this decline in prevalence may be slowed.

A systematic literature survey was carried out using Biomed Central, Cochrane Oral Health Reviews, Cochrane Library, Directory Of Open Access Journals, Expanded Academic ASAP PLUS, Meta Register of Controlled Trials, Science-Direct, PubMed, PubMed Central and Google Scholar and manually searched in the library for relevant published papers.

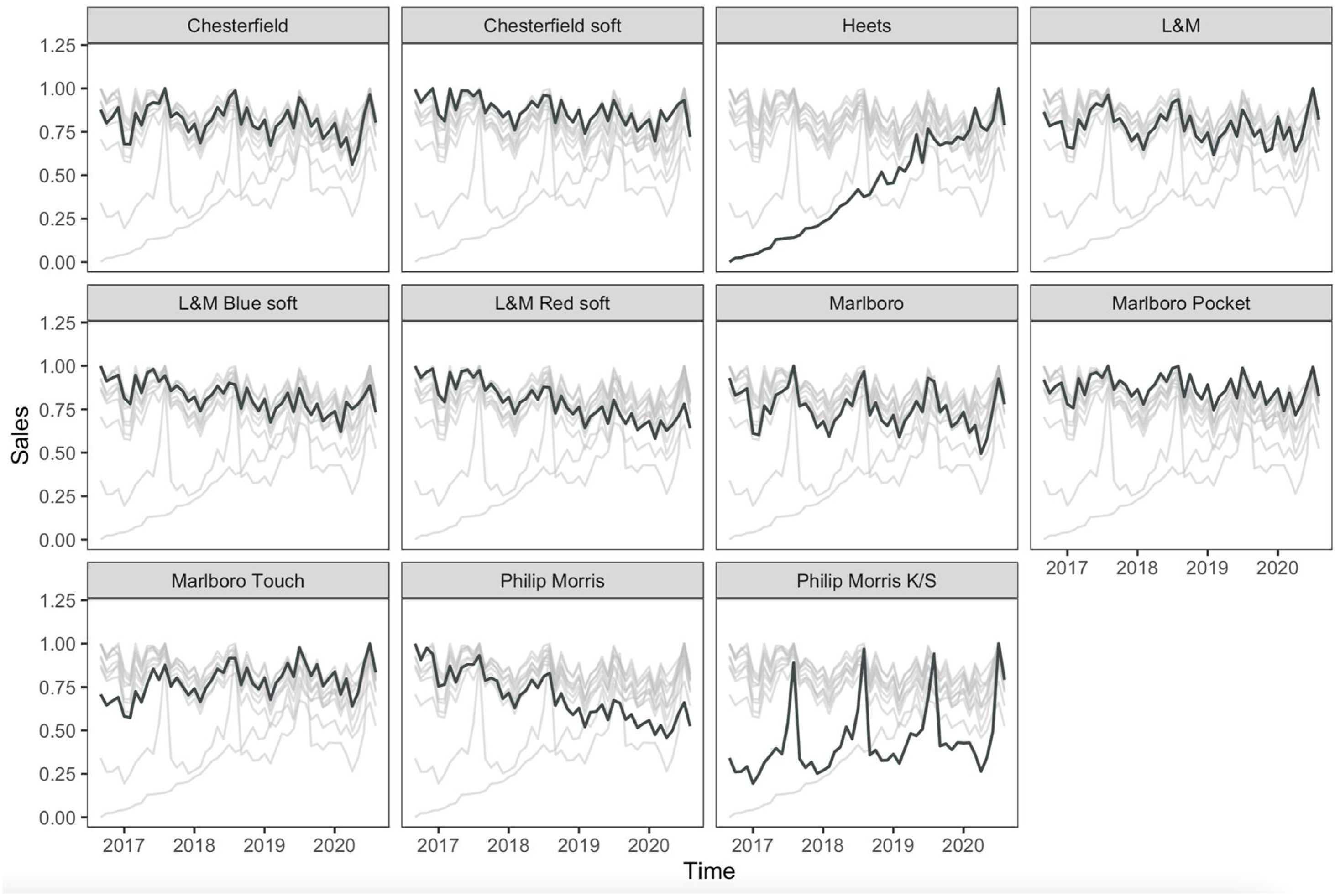

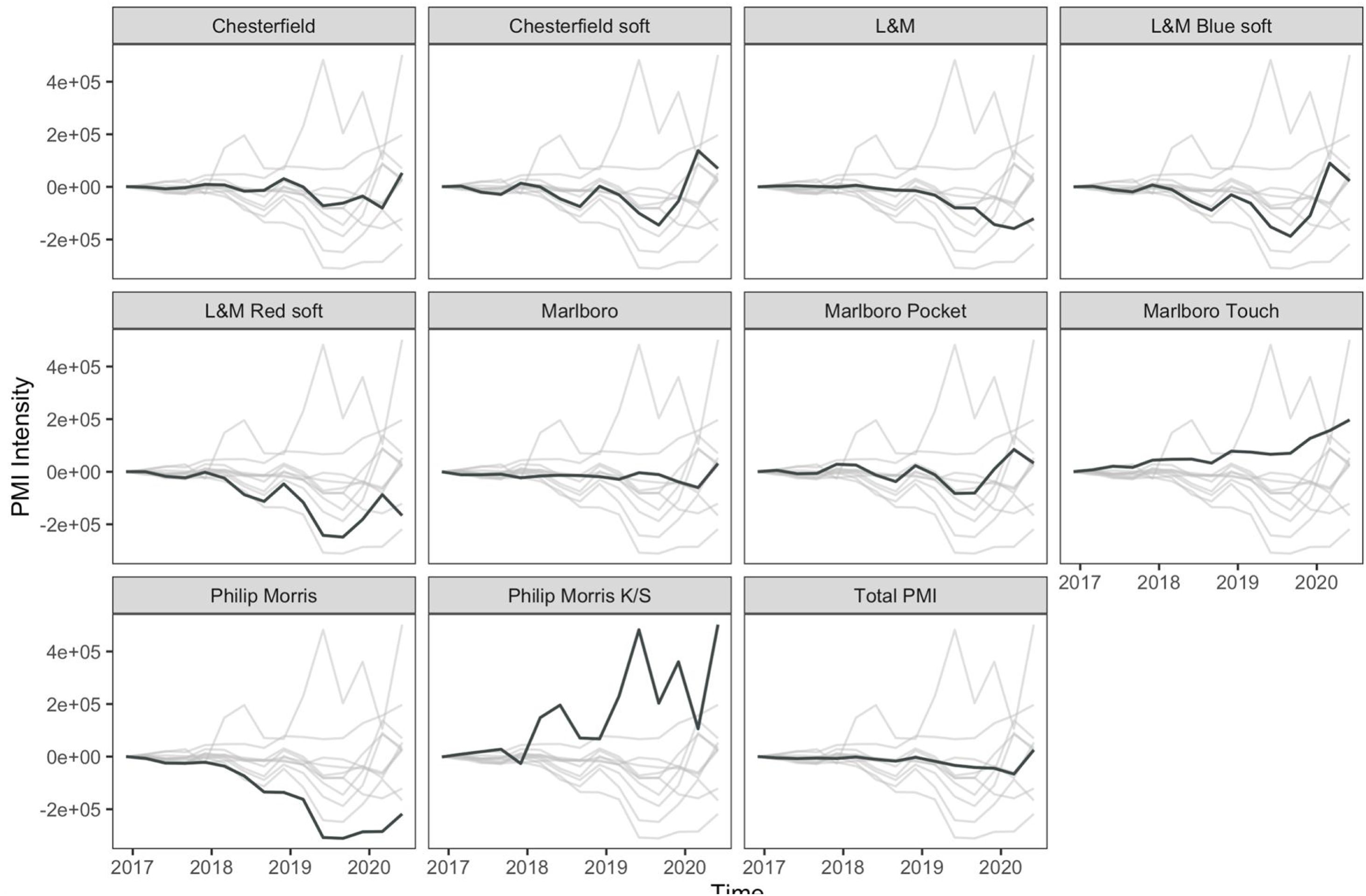

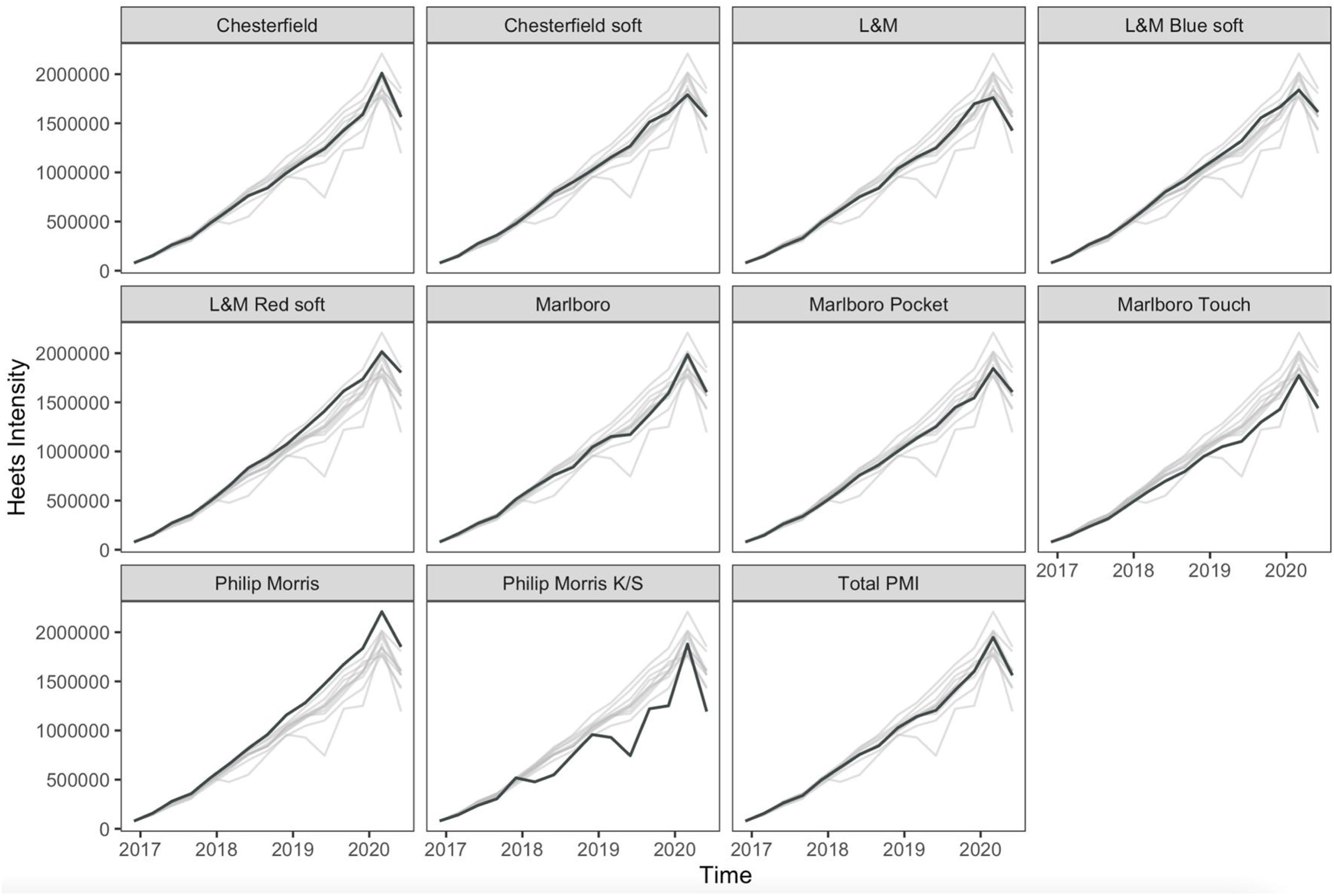

MethodDataWe developed a time series analysis of Heets and the 10 cigarette brands sold by PMI in Spain (Figure 1). Specifically, we use monthly time series for sales from September 2016 to June 2020 published by the Trade of Tobacco Commission (Commissioned for the Market of Tobacco) —an autonomous body created by Law 13/1998, to safeguard neutrality and free competition inside the Tobacco market within the national territory. Data on the adult population and gross domestic product (GDP) have been extracted from the National Institute of Statistics of Spain.

Heets sales data are provided in kilograms. To know the quantity of of 20 Heets sticks packets that correspond to each kilogram sold, the 2016 data has been used. In 2016, according to data from the Trade of Tobacco Commission, Heets sales were 866,345.80 euros, when the price of each pack was 4.85 euros. Given that there were 1,091.42 kilograms of Heets sold in 2016, each pack of 20 Heets sticks requires 6.11 grams (0.355 grams for each heating rod or stick). This is also an important finding, given that so far, the conversion for traditional cigarettes is 0.75-1 gram of tobacco for each cigarette.22

The use of official data assumes that sales to tourists are imputed as national consumption. The closure of borders during the month of April 2020 by COVID-19 has revealed that in some border provinces and / or with a high tourist influx, tobacco sales are highly dependent on sales to foreigners. However, although these sales to tourists imply a change of scale in some provinces, a homogeneous trend in cigarette consumption is observed that does not allow differentiating between provinces with tourist influx. In this sense, under this premise, there are many jobs that have used official cigarette sales, assimilating them to national consumption.22-26

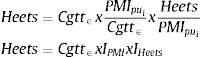

Empirical methodologyIn this study, index decomposition analysis is used, specifically the LMDI method. Fortunately, the wealth of data published by the Trade of Tobacco Commission (Commissioned by the Market of Tobaccos) allows us to decompose Heets sales according to the sales of any other PMI brand using only one identity function. The identity function, which is the basis of the decomposition analysis, is the representation of all the potential drivers identified by the researcher.27 This function is formulated as a product of the driving factors, see Eqs. 1 to 3). To provide robustness to the analysis of Heets substitutability for PMI cigarette sales, it is necessary to perform multiple decomposition analises using different identity functions. First, an identity function is used that considers the effect of population and economic growth (decomposition analysis 1). Second, another is used that takes into account the evolution of the Spanish cigarette market (decomposition analysis 2). The last used identity function considers the evolution of PMI's position in the market (decomposition analysis 3).

where Heets are sales in packs of 20 sticks of Heets, Pop is the adult population (18 years or over), GDP is gross domestic product, Cgtt€ is cigarette sales in euros, PMI€i are sales in euros of Philip Morris International brand i and PMIpui are the physical unit sales of Philip Morris International brand i.The first decomposition analysis considers as factors that can explain the sales of Heets, the adult population (Pop), the GDP per capita (GDPpc) and the price of products PMI (PPMI). There is broad consensus that these three factors are determining factors in tobacco sales.23,24,28 In addition, the intensity of cigarette use (Icgtt), the intensity of PMI's position in the market (IPMI) and the intensity of Heets's position within the portfolio (IHeets) are included in this identity function.

The second function of Identity raised helps to analyze Heets sales by isolating them from the effect that population and GDP have on them. Specifically, the second identity function only takes into account the evolution of the cigarette market (Cgtt €) and the intensity of sales of PMI (IPMI) and of Heets (IHeets), respectively.

Finally, the third identity equation considers as explanatory factors for Heets sales the PMI sales (PMI €i), the price of PMI products (PPMI) and the importance of Heets sales over the PMI product portfolio (IHeets).

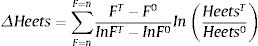

The advantage of the LMDI decomposition method is that it allows to quantify how much each factor affects the variation of Heets sales. Equation 4 shows how to calculate the individual effects.

where F is any of the Factors included in the identity functions in general (for example, adult population, GDP or the position of PMI in the market; T and 0 refer to the final time period and the base time period, respectively, so that FT and F0 refer to the corresponding values of said effect, for example population, in the time periods T and 0, respectively. More on the formulation of LMDI in.29,30ResultsIn this section, we try to discuss the results from three perspectives. In the first place, the results of the LMDI decomposition carried out with the identity function exposed in equation 1 are analyzed. This perspective allows the study of whether Heets sales are conditioned by the variables that are traditionally used as explanatory in the demand function of tobacco (adult population, GDP and price). Secondly, the results provided by the LMDI decomposition performed with the identity function of equation 2 are analyzed. These results allow us to verify whether the introduction of Heets in the market is a strategy by PMI to gain market share of Spanish tobacco. Finally, the results of the decomposition resulting from equation 3 are shown. These allow us to analyze whether Heets sales are conditioned by the price of the rest of the products that PMI sells in the Spanish tobacco market.

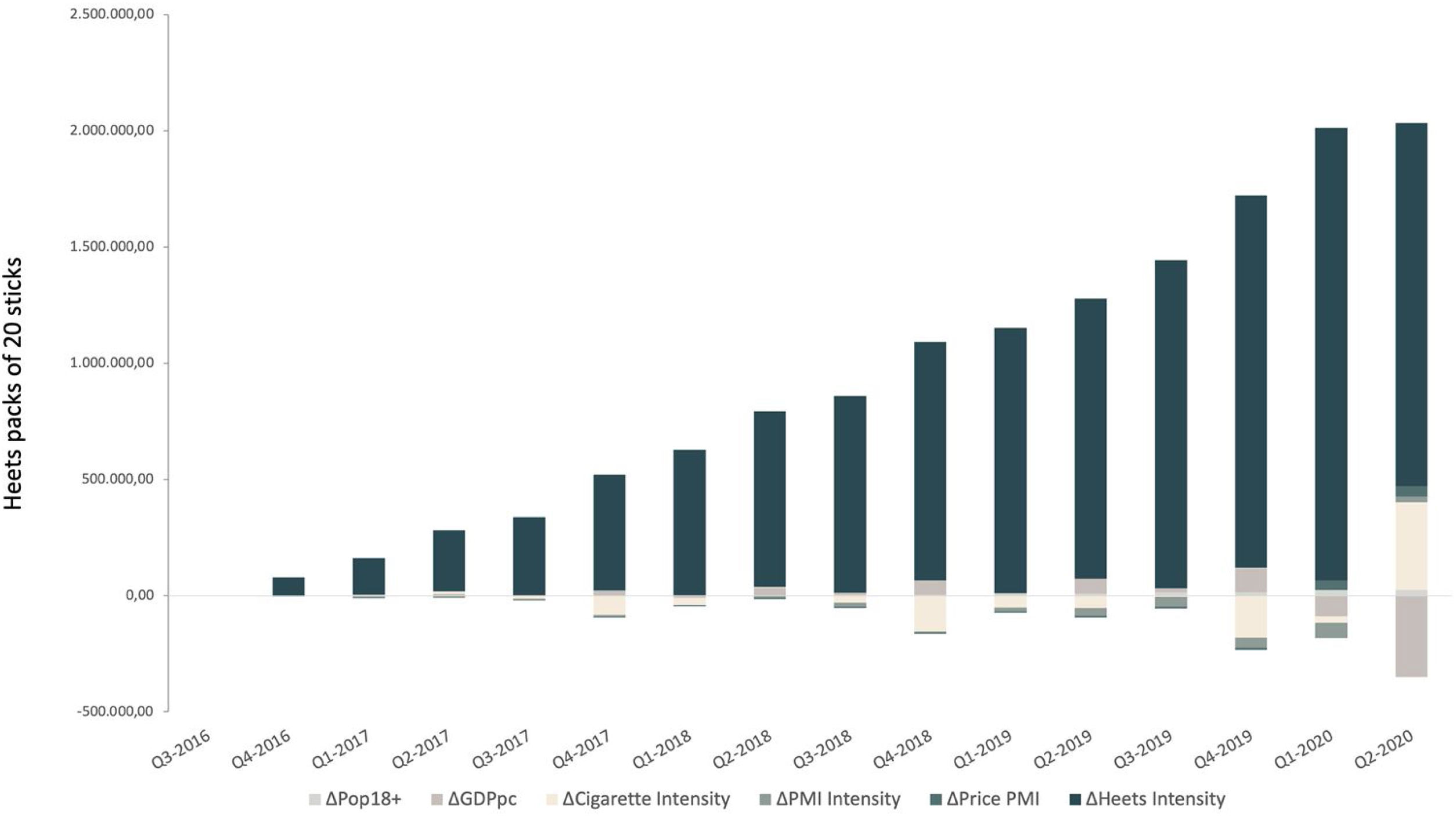

In Figure 2 the accumulated effects of the quarterly variations can be seen. As shown, most of the accumulated sales of Heets in Spain since its entry into the market is due to the positioning of this HTP brand as a substitute product for the traditional cigarette. It should be noted that there is an increase in the significance of GDP and the cigarette intensity factor (Icgrtt). This is due to the strong recession suffered in that quarter, motivated by the global COVID-19 pandemic. The recession negatively impacted Heets sales and increased the importance of the ratio of cigarette sales to GDP (Icgrtt).

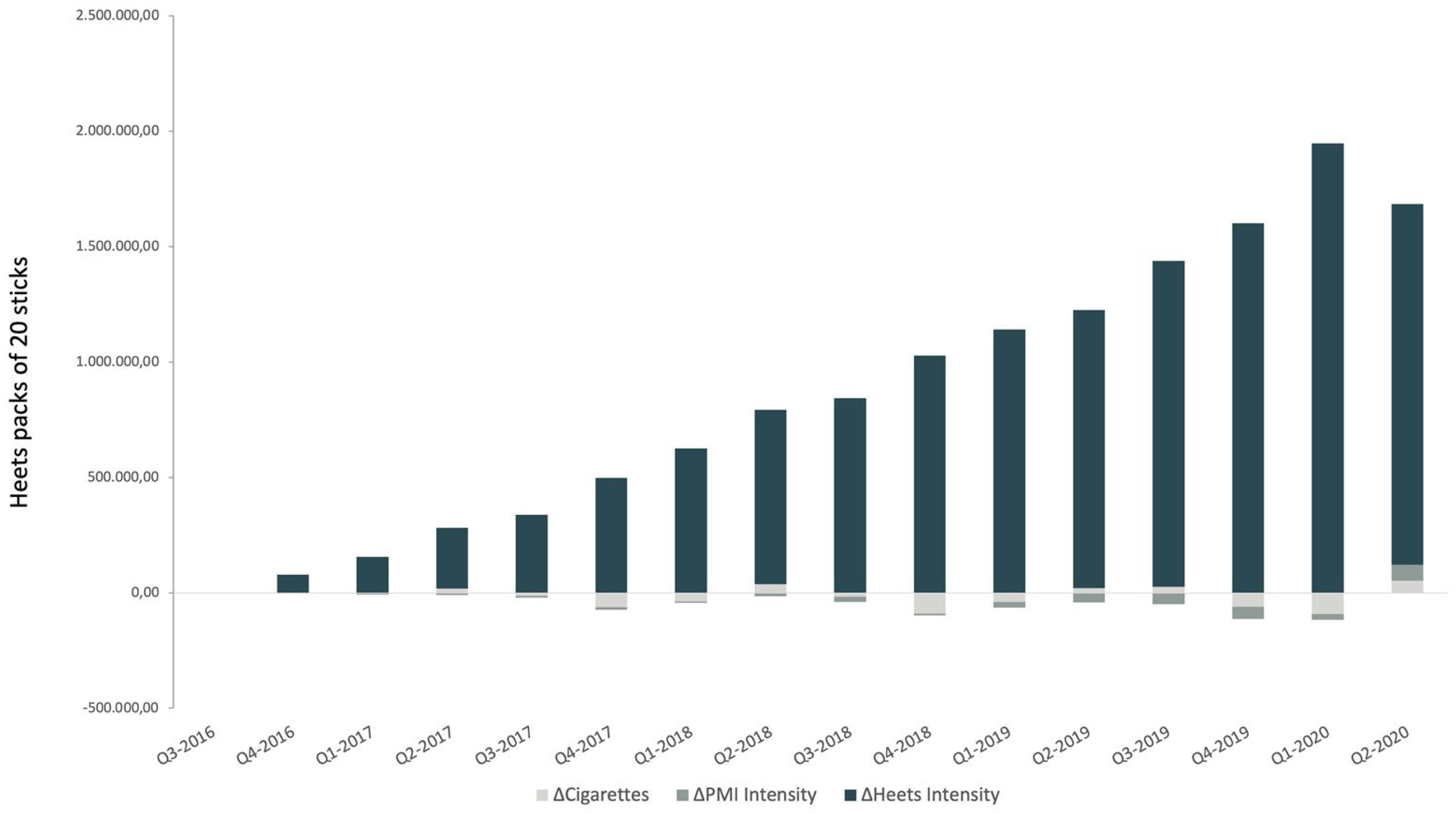

In addition, the results of the DA2 decomposition analysis are shown in Figure 3. As can be seen more clearly than in the DA1 decomposition analysis, almost all of the accumulated sales of Heets in Spain since its entry into the market is due to the positioning of this HTP brand as a substitute product for the traditional cigarette. It should be noted that the effect of the non-IHEETS factors is almost nil, so these results reinforce what has been stated in relation to the results of the DA1 decomposition analysis.

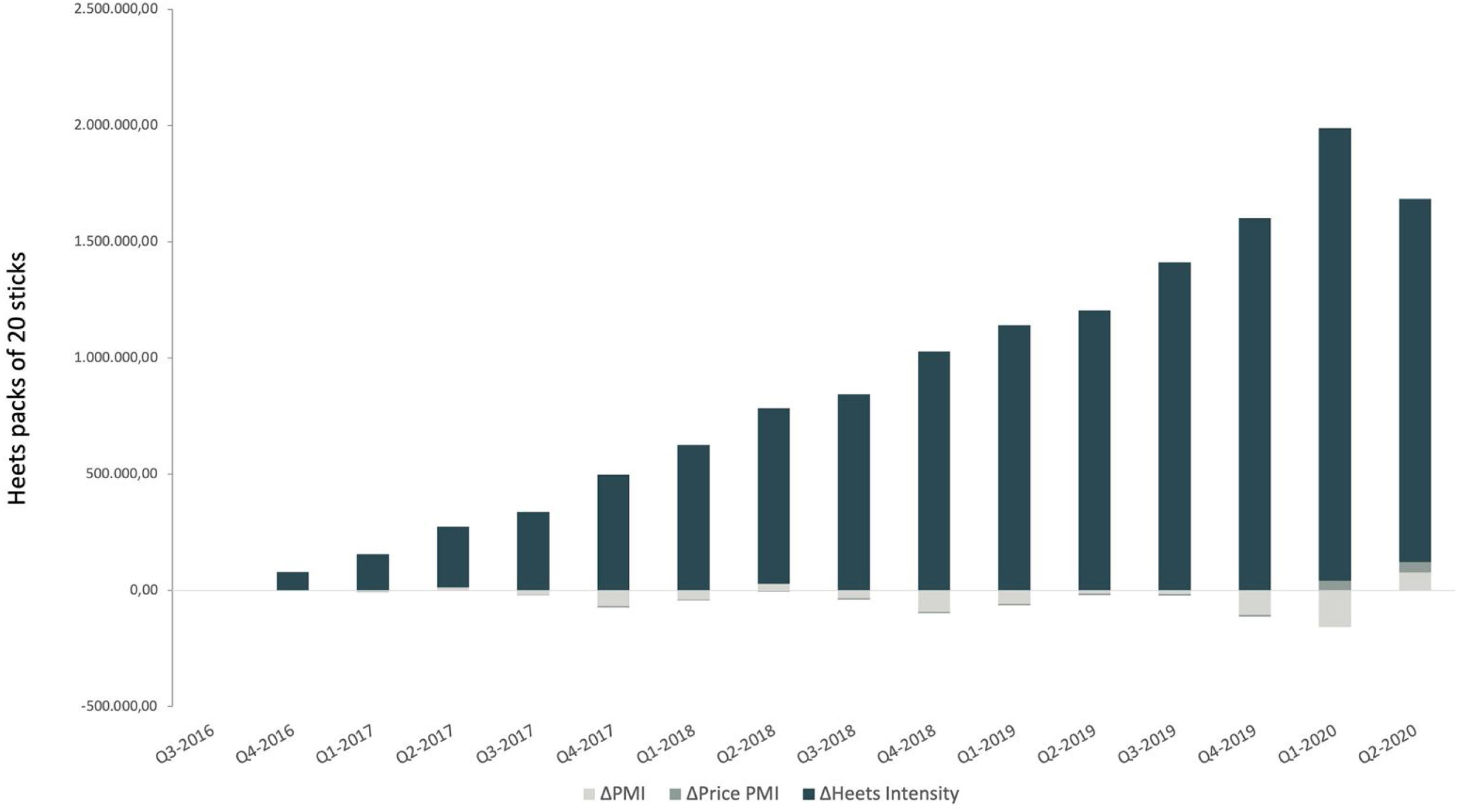

Finally, the results of the DA3 decomposition analysis are shown in Figure 4. Almost all of the accumulated sales of Heets in Spain since its entry into the market is due to the positioning of this HTP brand as a substitute product for the traditional cigarette and this can be seen more clearly than in the DA1 and DA2 decomposition analyses. It should be noted that the effect of the non-IHEETS factors is almost nil, so these results reinforce what has been stated in relation to the results of the DA1 and DA2 decomposition analyses.

As indicated in the methodology section, the DA1, DA2 and DA3 decomposition analyses have been replicated for each of the 10 traditional cigarette brands that PMI markets in Spain. Figures 2-4 show DA1, DA2 and DA3 results for total PMI sales in Spain. However, it is important to analyze the results by brand to know if the introduction of Heets in the market has been used to favorably position any other traditional cigarette brand. Figure 5 shows the aggregate effect of the IPMI factor for the DA1, DA2 and DA3 decomposition analyzes of each of the 10 brands that PMI markets in Spain. As can be seen, the aforementioned effect is around zero in almost all cases, so it seems that PMI has not used the introduction of Heets to position itself in the market with any of its other traditional cigarette brands.

Finally, Figure 6 shows the evolution of the aggregate effect that the IHEETS factor has had on Heets sales since its introduction. As can be seen, Heets has served as a substitute product for all the brands that PMI markets in Spain. This statement is due to the can be made because in all cases there is a positive slope and, furthermore, the Heets/PMI ratio (IHEETS) has almost the same shape as Heets sales since its introduction.

ConclusionsIn recent years, the number of new generation products with which tobacco companies want to replace the traditional cigarette is growing. The scientific literature affirms that HTPs are the ones that are best positioned for being sold as products with less risk to health, something on which there is no consensus at the moment, so it cannot be affirmed with any authority.

In this work, by applying three LMDI decomposition analyzes, we reveal that the introduction of Heets has replaced the rest of the brands that PMI markets in Spain. Although the results are in line with other previous studies, in Spain the substitution of Heets for the traditional cigarette is still not as successful as in other countries such as Japan.

The recommendations to the Spanish health and tax authorities derived from this study can be summarized in two. On the one hand, it seems that in Spain there is awareness of the diseases associated with tobacco consumption that make traditional cigarette smokers migrate to HTPs. In this sense, there are studies that indicate that there are consumers who perceive heated tobacco as less harmful to health but are not sure if this is really the case.31 Therefore, governments must legislate taking this situation into account, since migration to heated tobacco may be motivated by a false sense of healthy smoking. On the other hand, as far as the tax authorities are concerned, the results indicate that PMI is using Heets to replace the rest of the traditional cigarette brands it sells in Spain. Thus, although it appears that PMI is not improving its position in the total market with the launch of Heets, the tobacco company may be using the introduction of Heets to obtain tax advantages. The taxation of heated tobacco in Spain is currently 46%. If heated tobacco is taxed like traditional cigarettes, the price of 4.85 euros (price of a pack of Heets) corresponds to a tax rate of 61%. This difference in tax rate, together with the increasing volume of Heets sales in Spain, makes the difference between real tax collection and that which the government would obtain if Heets were taxed as traditional cigarettes is increasing. Specifically, during the period studied, this difference has exceeded 1% of the total collected, which implies almost one hundred million euros. Tax authorities must take this migration and the impact this may have on collection into account.

To summarize the practical policy implications that the results of this paper have for policy makers, these can be summarized into three. The first implication is that it appears that the healthy smoking sensation using heated tobacco is causing a migration of smokers from traditional cigarettes to heated tobacco. Second, policymakers should consider that heated tobacco tax regulation should be assimilated to cigarette taxation so that migration does not penalize tax collection. Finally, governments must control the behavior of cigarette substitute products, since a false sense of healthy smoking can reduce the decline in smoking.

A natural extension of this work for future research would be to widen the analysis to the rest of the tobacco products sold in Spain, which would give us a global answer on whether Heets’ sales growth is due to a change in consumer behavior with regards to these substitute products. Furthermore, another extension may be to analyze at the provincial level if the introduction of Heets has had the same effect throughout the Spanish territory. It would also be interesting to analyze the relationship between Heets sales and smoking prevalence measured with individualised data.

Transparency declarationThe corresponding author on behalf of the other authors guarantee the accuracy, transparency and honesty of the data and information contained in the study, that no relevant information has been omitted and that all discrepancies between authors have been adequately resolved and described.

Data and code availability statementPublic data deposited at the following URL has been used: https://www.hacienda.gob.es/es-ES/Areas%20Tematicas/CMTabacos/Paginas/EstadisticassobreelMercadodeTabacos.aspx

The data has been pre-processed and the dataset and the code used is available to editors, reviewers, and other researchers upon request.

PMI has considered replacing traditional cigarettes with its HTP alternative. IQOS is PMI's HTP alternative and in some statements the tobacco company has stated that IQOS is the only alternative for those adult smokers who quit traditional cigarettes. There is evidence from several countries on the behavior of IQOS sales. However, there is no evidence on whether PMI has used IQOS in Spain to gain market position or whether heated tobacco is replacing the traditional cigarette.

What does this study add to the literature?PMI's heated tobacco alternative, IQOS, is replacing the traditional cigarettes sold by that tobacco company in Spain. Although it has not improved its position in the market with the introduction of IQOS, this substitution may bring tax advantages to PMI due to the lower taxation of heated tobacco in Spain, compared to traditional cigarettes.

What are the implications of the results?It is important to review the taxation of the heated tobacco category in Spain. The migration of cigarette users to heated tobacco is generating tax benefits for Philip Morris International.

Manuel Franco.

Transparency declarationThe corresponding author on behalf of the other authors guarantee the accuracy, transparency and honesty of the data and information contained in the study, that no relevant information has been omitted and that all discrepancies between authors have been adequately resolved and described.

Authorship contributionsConception, design of this study and acquisition of data was in charge of A.A. Golpe and J.M. Martín-Álvarez. Analysis and interpretation of data, as well as drafting the article and final approval of the version to be published, were in charge of all of the authors.

FundingNone.

Conflicts of interestNone.