This study empirically analyzes the effects of public information about the pharmaceutical R&D process on the market valuation of the sponsoring firm. We examined the market's response to scientific news and regulatory decisions about an antiobesity drug, rimonabant, and the effects on the sponsoring company (Sanofi-Aventis) and its incumbent competitors (Abbott and Roche).

MethodsEvent study methodology was used to test the null hypothesis of no market response. We covered the full life cycle of rimonabant (1994-2008), using a data set of daily closing price and volume.

ResultsThe results suggest that scientific news in the initial stages of the drug R&D process (i.e., drug discovery, preclinical and clinical trials) had no significant effects. However, news related to regulatory decisions, such as recall or safety warning, had significant negative effects on the company's market value. No spillover/contagion effects on competitor firms were detected.

ConclusionMarket reactions occur at the time when the regulator takes decisions about drugs. Scientific news, even those of high-impact, may pass unnoticed.

Este trabajo analiza empíricamente los efectos de la información pública sobre la I+D en la valoración de mercado de una empresa farmacéutica. Examinamos la respuesta del mercado a las noticias científicas y a las decisiones de regulación de un medicamento para la obesidad, el rimonabant (Sanofi-Aventis), sobre la propia compañía y sobre sus competidoras (Abbott y Roche).

MétodosSe aplicó la metodología de estudio de eventos para contrastar la hipótesis de ausencia de respuesta del mercado. Cubrimos el ciclo de vida completo del rimonabant (1994-2008), utilizando una base de datos de precio y volumen de negociación diarios al cierre.

ResultadosLos resultados sugieren que las noticias científicas en las etapas iniciales del proceso de I+D (es decir, el descubrimiento del fármaco y los ensayos preclínicos y clínicos) no tuvieron efectos significativos, pero las noticias relacionadas con las decisiones regulatorias (retirada o alerta de seguridad) sí tuvieron efectos negativos significativos en el valor de mercado de la empresa. No se detectaron efectos cruzados en las empresas competidoras.

ConclusiónLas reacciones de los mercados se producen en el momento en que el regulador toma decisiones sobre medicamentos. Las noticias científicas, incluso las de gran impacto, pueden pasar desapercibidas.

Empirical evidence analyzing the effects of public information on a specific new drug R&D process on the market valuation of the sponsoring firm and on its competitors remains limited. Changes in prices, particularly abnormal returns, are the market's reaction to unanticipated news. Some changes in prices are due to new pharmacologic information on the mechanism of action of the drugs, their therapeutic advantages or problems. The medical community interprets stock price changes as reflecting safety problems with the drug,1 and some doctors are involved in investment advice activities and monitoring the regulatory process.2–4 Diverse factors may affect stock prices, including product approvals, product failures, a robust pipeline, research milestones achieved, data and information on pipeline status, the hiring and retention of quality scientists and staff, and research collaborations and alliances with external entities.5 Hence, it is expected that financial markets should respond to clear signs of success or disappointment, as reflected in news announcements concerning the drug R&D process.

In the present article we investigate the relationship between the R&D process of a specific drug and stock prices. Firstly, we test whether the stock prices for the pharmaceutical company that sponsors the drug respond to the information arising from the drug R&D process. Testing this hypothesis will establish whether scientific information stemming from research and drug discovery, preclinical tests, clinical trials and regulatory authority decisions [such as the Food & Drug Administration (FDA), European Medicines Agency (EMA) and National Institute of Health and Clinical Excellence (NICE)] about its market use (commercialization) or withdrawal have any effects on stock prices. Secondly, we test whether the stock prices of direct pharmaceutical competitors react to the same information. This test allows us to determine whether there is any evidence of spillover effects on the manufacturers of substitute products,6-8 or whether the intra-industry impact of a drug's withdrawal might produce a contagion or a competitive effect.6,9

We examined the R&D cycle of the antiobesity drug rimonabant (Acomplia® or Zimulti®), manufactured by Sanofi-Aventis, which constitutes an excellent case study. In just a few years, this drug began and ended a history of great promise, serious doubt and resounding failure, evolving from being the brightest star in the company's firmament to disappearing completely from the galaxy. Rimonabant was sold in the European Union but was not authorized by the FDA in the USA and was withdrawn from the European market by the EMA after 2 years on sale due to safety problems. There were only two clearly identifiable competitors on the market: sibutramine (Reductil®), made by Abbott Knoll, and orlistat (Xenical®), by Roche, and consequently the estimation of spillover effects was straightforward.

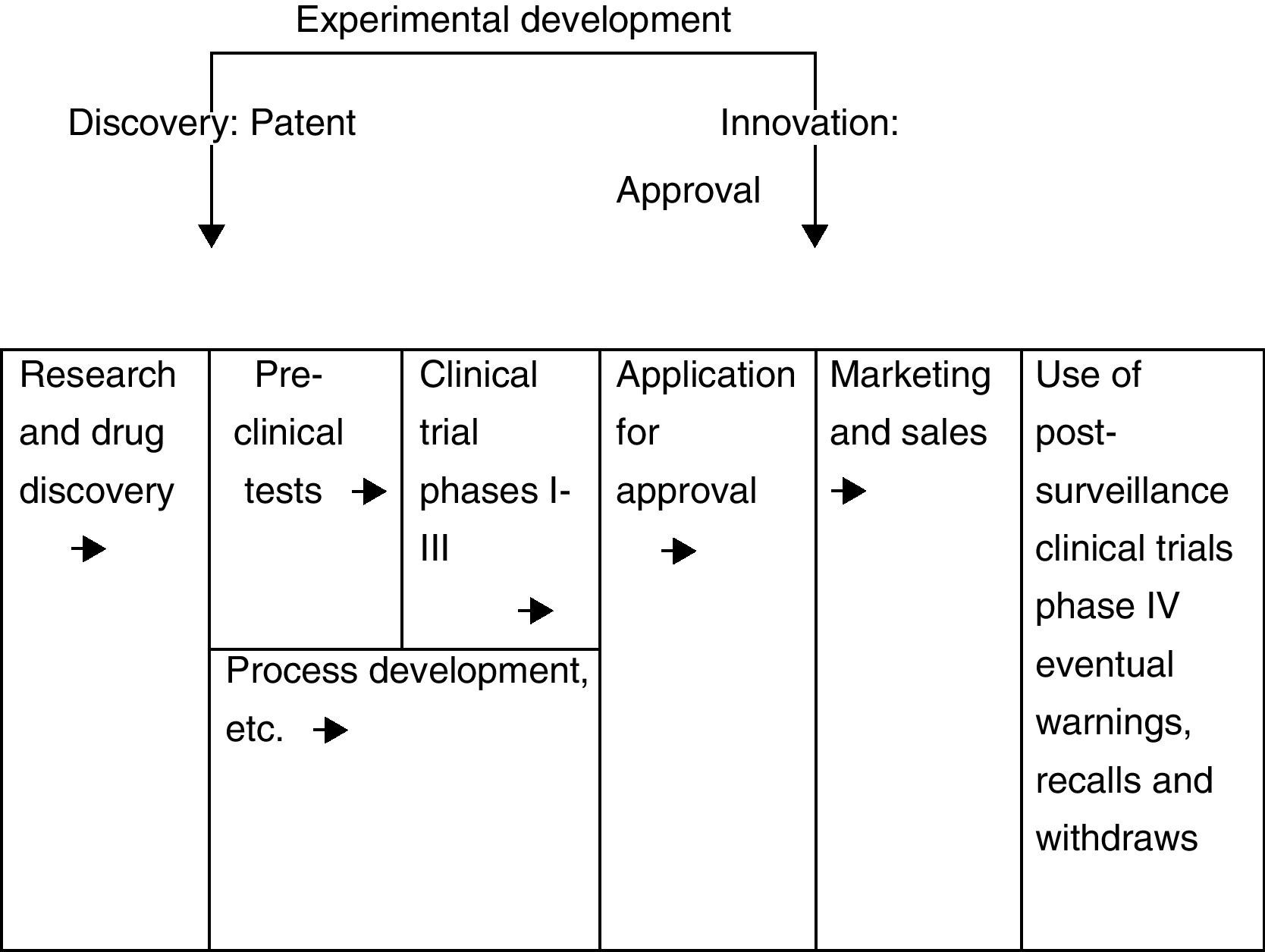

The linear model for the drug R&D process: the rimonabant caseIn general, in all R&D processes, there are two particularly significant time points, those of discovery and innovation. In the case of the pharmaceutical industry, there tends to be a substantial interval between these time points because the R&D of new drugs is an extremely lengthy (and costly) process.

The formal R&D process of a drug is the movement in the drug pipeline toward final approval. The R&D process, which is strictly regulated at every stage by the corresponding governmental authority, can thus be viewed as a linear model,10 characterized by stages including research and drug discovery, preclinical tests, preclinical trial commencement, investigational new drug submission, clinical trials (phases I, II and III), process development in parallel with product tests, and filing (fig. 1).

From the discovery of a new drug (patent) to the innovation (approval) time, the distribution of the entry lag varies substantially. The testing and approval process takes considerable time, sometimes a long time, depending on the severity of the disease and many other factors such as the available therapies and the efficacy and safety claims of the new drug. After product approval by governmental authorities, commercialization may begin. Clinical trials will continue to be performed, as the drug may be found to have serious adverse effects, forcing the authorities to have it withdrawn from the market.

Rimonabant event historyObesity is a pandemic health problem worldwide. There are currently one billion overweight adults, of whom at least 300 million are obese.11 The potential market for antiobesity treatment is, therefore, considerable.12 Despite the very limited effectiveness of pharmacological approaches,13 the pharmaceutical industry is continually investigating new drugs.14–16

In 1997, two appetite-reducing drugs, fenfluramine and dexfenfluramine, were withdrawn from the market after serious adverse cardiac valve effects were reported,17–23 and in 2001, only two new products were marketed, orlistat and sibutramine, both of which were approved in 1998.

In 2001, clinical trials began of a new drug, rimonabant, produced by the company Sanofi and patented in 1994.

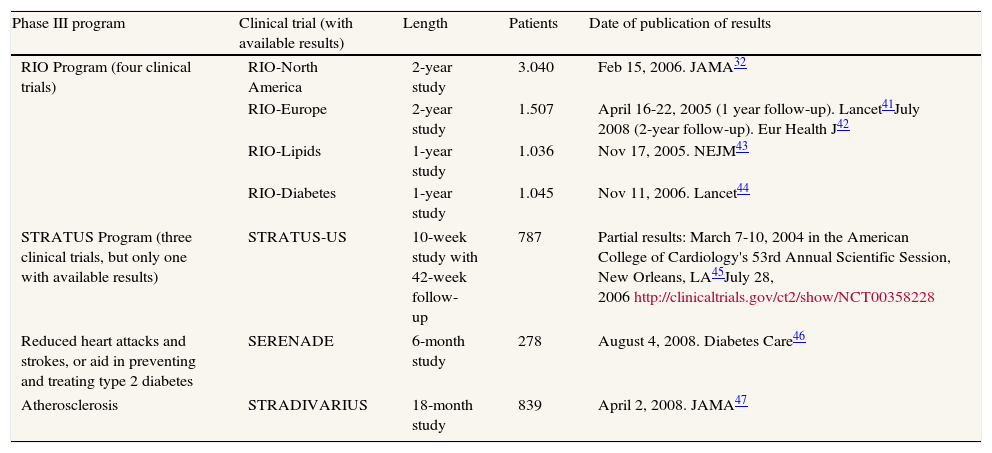

Rimonabant acts on cannabinol receptors to suppress the appetite and was described as “one drug inspired by another”.24 However, its entire life cycle lasted only 14 years, from 1994 to 2008. Rimonabant went from being viewed as a potential blockbuster and star medicament in 2001, to being withdrawn from the European market in late 2008. The high hopes aroused by this drug were due not only to its weight loss effects but also to its ability to improve the analytical results of patients with metabolic syndrome and/or diabetes. Rimonabant's failure was due to its adverse psychiatric effects, doubling the risk of depressive disorders. From 1994 to 2008, there were scientific and regulatory events. The results of the main clinical trials before 2007 (table 1) were published in the most influential and prestigious medical journals but, from 2007-2008, tended to appear more in specialist journals, except the STRADIVARIUS trial, which examined the drug's effects on atherosclerosis. Some of these trials were of only limited interest due to their small sample size, which was the case of SERENADE, with only 278 patients.

Clinical trials in phase III from 2001 to 2008 with available results, and publication of results

| Phase III program | Clinical trial (with available results) | Length | Patients | Date of publication of results |

| RIO Program (four clinical trials) | RIO-North America | 2-year study | 3.040 | Feb 15, 2006. JAMA32 |

| RIO-Europe | 2-year study | 1.507 | April 16-22, 2005 (1 year follow-up). Lancet41July 2008 (2-year follow-up). Eur Health J42 | |

| RIO-Lipids | 1-year study | 1.036 | Nov 17, 2005. NEJM43 | |

| RIO-Diabetes | 1-year study | 1.045 | Nov 11, 2006. Lancet44 | |

| STRATUS Program (three clinical trials, but only one with available results) | STRATUS-US | 10-week study with 42-week follow- up | 787 | Partial results: March 7-10, 2004 in the American College of Cardiology's 53rd Annual Scientific Session, New Orleans, LA45July 28, 2006http://clinicaltrials.gov/ct2/show/NCT00358228 |

| Reduced heart attacks and strokes, or aid in preventing and treating type 2 diabetes | SERENADE | 6-month study | 278 | August 4, 2008. Diabetes Care46 |

| Atherosclerosis | STRADIVARIUS | 18-month study | 839 | April 2, 2008. JAMA47 |

RIO: Rimonabant In Obesity; STRATUS: Studies with Rimonabant and Tobacco Use; SERENADE: Study Evaluating Rimonabant Efficacy in Drug Naïve Diabetic Patients; STRADIVARIUS: Strategy To Reduce Atherosclerosis Development Involving Administration of Rimonabant - the Intravascular Ultrasound Study.

The first setback in the rimonabant process took place in February 2006, when the FDA delayed approval and denied authorization for the drug to be used as an aid to smoking cessation and demanded further safety trials. One week previously, JAMA had published the partial results of the RIO-North America 2-year follow-up clinical trial. Although these appeared to be satisfactory, there were grey areas; in particular, half of the patients had been lost to follow-up. The large-scale RIO-diabetes trial had produced promising results in January 2002 and June 2005, but the partial results issued in November 2006 gave investors a nasty surprise when safety problems and adverse psychiatric effects were detected. Other clearly negative events occurred in 2007 and 2008: the non-authorization by the FDA (June 13, 2007); the report by the British Medicines and Healthcare Products Regulatory Agency of adverse events –five deaths and over 700 cases of averse reactions between early 2006 and May 2008 (June 3, 2008); the poor results of the STRADIVARIUS clinical trial (July 16, 2008); and finally, the withdrawal of rimonabant from European markets ordered by the EMA (October 23, 2008).

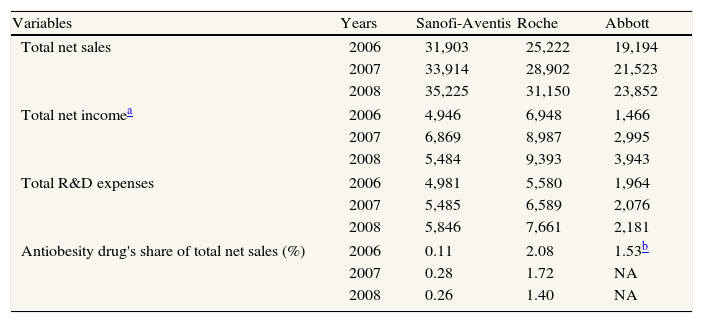

In June 2006, sales of rimonabant began in Europe, where it was marketed under the name of Acomplia®. The drug was eventually withdrawn in 2008, having accumulated total sales of €57 million in the first half of that year, of which €34 million corresponded to the second quarter. Table 2 shows annual financial data for Sanofi-Aventis, Roche and Abbott from 2006 to 2008.

Some important financial variables for each company. Millions $US (corrected by inflation, CPI base year= 2000). Period 2006-2008

| Variables | Years | Sanofi-Aventis | Roche | Abbott |

| Total net sales | 2006 | 31,903 | 25,222 | 19,194 |

| 2007 | 33,914 | 28,902 | 21,523 | |

| 2008 | 35,225 | 31,150 | 23,852 | |

| Total net incomea | 2006 | 4,946 | 6,948 | 1,466 |

| 2007 | 6,869 | 8,987 | 2,995 | |

| 2008 | 5,484 | 9,393 | 3,943 | |

| Total R&D expenses | 2006 | 4,981 | 5,580 | 1,964 |

| 2007 | 5,485 | 6,589 | 2,076 | |

| 2008 | 5,846 | 7,661 | 2,181 | |

| Antiobesity drug's share of total net sales (%) | 2006 | 0.11 | 2.08 | 1.53b |

| 2007 | 0.28 | 1.72 | NA | |

| 2008 | 0.26 | 1.40 | NA | |

All information, except antiobesity drug's share of total net sales, was obtained from the annual and financial reports of each company, expressed in local currency. The $US values of Sanofi-Aventis and Roche were obtained by considering the following mean annual exchange rates: $US/EUR: 1.256, 1.371, 1.471; and CHF/$US: 1.252, 1.198, 1.079, for 2006, 2007 and 2008, respectively. All data were corrected by the CPI (=2000, source OECD). Antiobesity drug's share of total net sales is percentage of sales for the antiobesity drug (rimonabant, xenical and sibutramine, respectively) on total net sales.

CPI: consumer price index; OECD: Organization for Economic Cooperation and Development; NA: not available.

For the manufacturer, rimonabant represented a relatively modest contribution to total revenue, reaching a maximum of 0.28% in 2007 in comparison with the 1.72% achieved by the competing product marketed by Roche. Nevertheless, the rate of net sales of rimonabant was rising while that of Roche's orlistat was falling. In 2007, sales of rimonabant increased by 171% with respect to 2006 and in 2008 and, until the product was withdrawn from the market, sales continued to increase. In contrast, orlistat sales fell by 5% and 12%, respectively, in 2007 and 2008. These figures suggest that a substitution effect was taking place.

R&D expenses on Acomplia® were €41 million in 2008, representing a minimal 0.61% share of Sanofi-Aventis’ total R&D expenses.

Data and methodsDataIn our study we matched two databases, the first containing stock prices and stock market indexes, and the second, news about scientific matters related to rimonabant (database of events). Our first data set consisted of the daily closing prices adjusted for dividends and splits of the daily prices of the New York Stock Exchange (NYSE) pharmaceutical companies Abbott Laboratories, Sanofi (before its merger with Aventis in December 2004), Sanofi-Aventis, and Roche Holding AG-Genusschein, a Zurich-listed company. We also formed an equally-weighted pharmaceutical stock portfolio index by using all pharmaceutical NYSE-listed companies as a proxy of the market index. The data were obtained from Bloomberg and covered the whole life cycle of the drug studied. The prices were transformed into logarithms to compute continuous returns.

Our second data set consisted of daily news related to rimonabant's clinical trials obtained from medical journals, from the FDA and EMA, and from other public sources including Factiva. For the period 2002-2008, covered by Factiva, we detected 1,133 news items (most of them were repeated) by using the search criteria “rimonabant” and “clinical trial”. Then, we filtered these news items to include only those reporting results presented at medical congresses or published in academic journals as well as relevant scientific news and reports published in the Financial Times, the Wall St Journal, the New York Times and other leading newspapers.

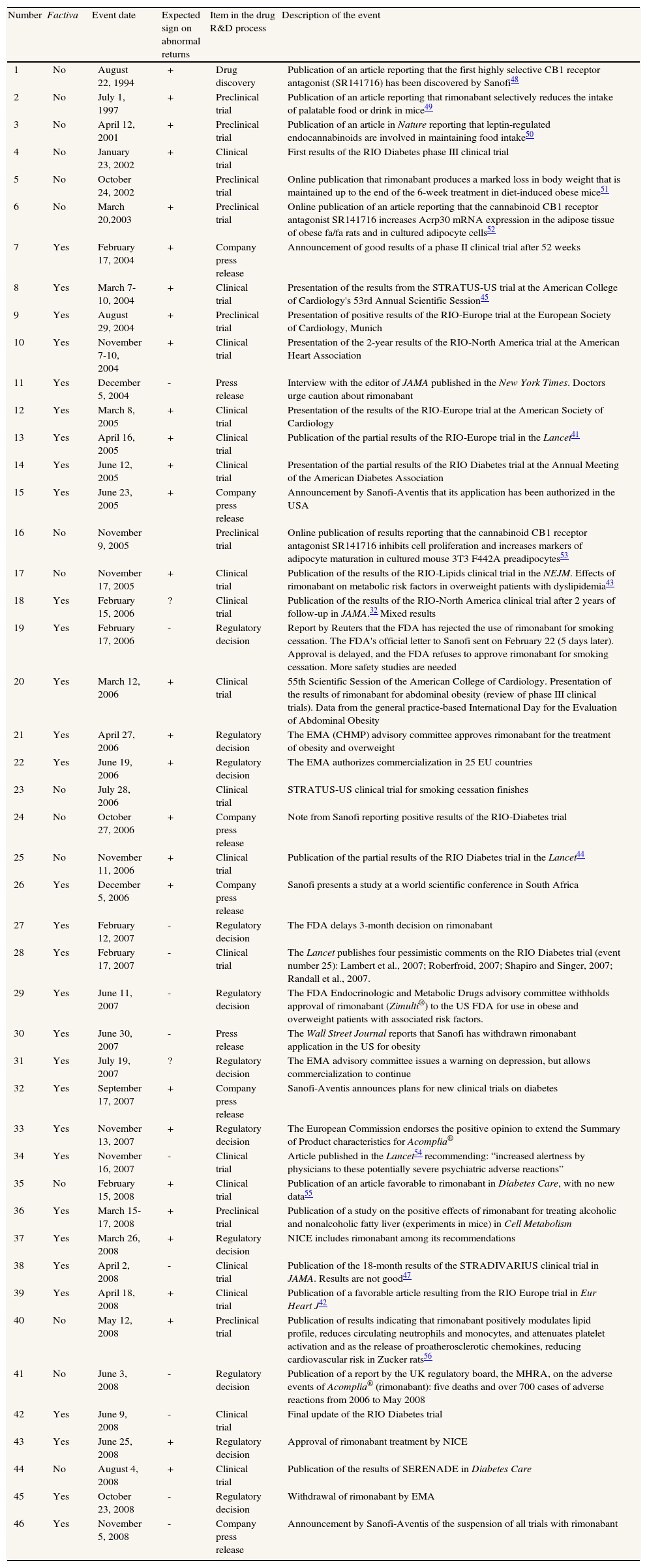

Table 3 displays the 46 events in the R&D lifecycle of rimonabant as modelled in this study; 31 of these events (67%) were reported in Factiva. Some partial or complete results from clinical trials were presented at medical congresses (seven events: numbers 8-9, 10, 12, 14, 20, 26). Scientific journals published results from preclinical and clinical trials (26 events: numbers 2-6, 8-10, 12-14, 16-18, 20, 23, 25, 28, 35-36, 38-40, 42 and 44). The decisions and statements made by the FDA in the USA and the EMA in the EU constituted nine events (numbers 19, 21-22, 27, 29, 31, 37, 41 and 45) and the NICE recommendation made in the UK is event number 43. In addition, there were six events of announcements by the company related to this drug (numbers 7, 15, 24, 26, 32 and 46).

Relevant events in the R&D process of rimonabant

| Number | Factiva | Event date | Expected sign on abnormal returns | Item in the drug R&D process | Description of the event |

| 1 | No | August 22, 1994 | + | Drug discovery | Publication of an article reporting that the first highly selective CB1 receptor antagonist (SR141716) has been discovered by Sanofi48 |

| 2 | No | July 1, 1997 | + | Preclinical trial | Publication of an article reporting that rimonabant selectively reduces the intake of palatable food or drink in mice49 |

| 3 | No | April 12, 2001 | + | Preclinical trial | Publication of an article in Nature reporting that leptin-regulated endocannabinoids are involved in maintaining food intake50 |

| 4 | No | January 23, 2002 | + | Clinical trial | First results of the RIO Diabetes phase III clinical trial |

| 5 | No | October 24, 2002 | Preclinical trial | Online publication that rimonabant produces a marked loss in body weight that is maintained up to the end of the 6-week treatment in diet-induced obese mice51 | |

| 6 | No | March 20,2003 | + | Preclinical trial | Online publication of an article reporting that the cannabinoid CB1 receptor antagonist SR141716 increases Acrp30 mRNA expression in the adipose tissue of obese fa/fa rats and in cultured adipocyte cells52 |

| 7 | Yes | February 17, 2004 | + | Company press release | Announcement of good results of a phase II clinical trial after 52 weeks |

| 8 | Yes | March 7-10, 2004 | + | Clinical trial | Presentation of the results from the STRATUS-US trial at the American College of Cardiology's 53rd Annual Scientific Session45 |

| 9 | Yes | August 29, 2004 | + | Preclinical trial | Presentation of positive results of the RIO-Europe trial at the European Society of Cardiology, Munich |

| 10 | Yes | November 7-10, 2004 | + | Clinical trial | Presentation of the 2-year results of the RIO-North America trial at the American Heart Association |

| 11 | Yes | December 5, 2004 | - | Press release | Interview with the editor of JAMA published in the New York Times. Doctors urge caution about rimonabant |

| 12 | Yes | March 8, 2005 | + | Clinical trial | Presentation of the results of the RIO-Europe trial at the American Society of Cardiology |

| 13 | Yes | April 16, 2005 | + | Clinical trial | Publication of the partial results of the RIO-Europe trial in the Lancet41 |

| 14 | Yes | June 12, 2005 | + | Clinical trial | Presentation of the partial results of the RIO Diabetes trial at the Annual Meeting of the American Diabetes Association |

| 15 | Yes | June 23, 2005 | + | Company press release | Announcement by Sanofi-Aventis that its application has been authorized in the USA |

| 16 | No | November 9, 2005 | Preclinical trial | Online publication of results reporting that the cannabinoid CB1 receptor antagonist SR141716 inhibits cell proliferation and increases markers of adipocyte maturation in cultured mouse 3T3 F442A preadipocytes53 | |

| 17 | No | November 17, 2005 | + | Clinical trial | Publication of the results of the RIO-Lipids clinical trial in the NEJM. Effects of rimonabant on metabolic risk factors in overweight patients with dyslipidemia43 |

| 18 | Yes | February 15, 2006 | ? | Clinical trial | Publication of the results of the RIO-North America clinical trial after 2 years of follow-up in JAMA.32 Mixed results |

| 19 | Yes | February 17, 2006 | - | Regulatory decision | Report by Reuters that the FDA has rejected the use of rimonabant for smoking cessation. The FDA's official letter to Sanofi sent on February 22 (5 days later). Approval is delayed, and the FDA refuses to approve rimonabant for smoking cessation. More safety studies are needed |

| 20 | Yes | March 12, 2006 | + | Clinical trial | 55th Scientific Session of the American College of Cardiology. Presentation of the results of rimonabant for abdominal obesity (review of phase III clinical trials). Data from the general practice-based International Day for the Evaluation of Abdominal Obesity |

| 21 | Yes | April 27, 2006 | + | Regulatory decision | The EMA (CHMP) advisory committee approves rimonabant for the treatment of obesity and overweight |

| 22 | Yes | June 19, 2006 | + | Regulatory decision | The EMA authorizes commercialization in 25 EU countries |

| 23 | No | July 28, 2006 | Clinical trial | STRATUS-US clinical trial for smoking cessation finishes | |

| 24 | No | October 27, 2006 | + | Company press release | Note from Sanofi reporting positive results of the RIO-Diabetes trial |

| 25 | No | November 11, 2006 | + | Clinical trial | Publication of the partial results of the RIO Diabetes trial in the Lancet44 |

| 26 | Yes | December 5, 2006 | + | Company press release | Sanofi presents a study at a world scientific conference in South Africa |

| 27 | Yes | February 12, 2007 | - | Regulatory decision | The FDA delays 3-month decision on rimonabant |

| 28 | Yes | February 17, 2007 | - | Clinical trial | The Lancet publishes four pessimistic comments on the RIO Diabetes trial (event number 25): Lambert et al., 2007; Roberfroid, 2007; Shapiro and Singer, 2007; Randall et al., 2007. |

| 29 | Yes | June 11, 2007 | - | Regulatory decision | The FDA Endocrinologic and Metabolic Drugs advisory committee withholds approval of rimonabant (Zimulti®) to the US FDA for use in obese and overweight patients with associated risk factors. |

| 30 | Yes | June 30, 2007 | - | Press release | The Wall Street Journal reports that Sanofi has withdrawn rimonabant application in the US for obesity |

| 31 | Yes | July 19, 2007 | ? | Regulatory decision | The EMA advisory committee issues a warning on depression, but allows commercialization to continue |

| 32 | Yes | September 17, 2007 | + | Company press release | Sanofi-Aventis announces plans for new clinical trials on diabetes |

| 33 | Yes | November 13, 2007 | + | Regulatory decision | The European Commission endorses the positive opinion to extend the Summary of Product characteristics for Acomplia® |

| 34 | Yes | November 16, 2007 | - | Clinical trial | Article published in the Lancet54 recommending: “increased alertness by physicians to these potentially severe psychiatric adverse reactions” |

| 35 | No | February 15, 2008 | + | Clinical trial | Publication of an article favorable to rimonabant in Diabetes Care, with no new data55 |

| 36 | Yes | March 15-17, 2008 | + | Preclinical trial | Publication of a study on the positive effects of rimonabant for treating alcoholic and nonalcoholic fatty liver (experiments in mice) in Cell Metabolism |

| 37 | Yes | March 26, 2008 | + | Regulatory decision | NICE includes rimonabant among its recommendations |

| 38 | Yes | April 2, 2008 | - | Clinical trial | Publication of the 18-month results of the STRADIVARIUS clinical trial in JAMA. Results are not good47 |

| 39 | Yes | April 18, 2008 | + | Clinical trial | Publication of a favorable article resulting from the RIO Europe trial in Eur Heart J42 |

| 40 | No | May 12, 2008 | + | Preclinical trial | Publication of results indicating that rimonabant positively modulates lipid profile, reduces circulating neutrophils and monocytes, and attenuates platelet activation and as the release of proatherosclerotic chemokines, reducing cardiovascular risk in Zucker rats56 |

| 41 | No | June 3, 2008 | - | Regulatory decision | Publication of a report by the UK regulatory board, the MHRA, on the adverse events of Acomplia® (rimonabant): five deaths and over 700 cases of adverse reactions from 2006 to May 2008 |

| 42 | Yes | June 9, 2008 | - | Clinical trial | Final update of the RIO Diabetes trial |

| 43 | Yes | June 25, 2008 | + | Regulatory decision | Approval of rimonabant treatment by NICE |

| 44 | No | August 4, 2008 | + | Clinical trial | Publication of the results of SERENADE in Diabetes Care |

| 45 | Yes | October 23, 2008 | - | Regulatory decision | Withdrawal of rimonabant by EMA |

| 46 | Yes | November 5, 2008 | - | Company press release | Announcement by Sanofi-Aventis of the suspension of all trials with rimonabant |

STRATUS-US trial: Smoking Cessation in Smokers Motivated to Quit; RIO: Rimonabant in Obesity; FDA: Food and Drug Administration; MHRA: Medicines and Healthcare products Regulatory Agency; NICE: National Institute for Health and Clinical Excellence; EMA: European Medicines Agency; CHMP: Committee for Medicinal Products for Human Use; STRADIVARIUS: Strategy To Reduce Atherosclerosis Development InVolving Administration of Rimonabant - the Intravascular Ultrasound Study.

Only two of the 46 events (numbers 18 and 31 in table 3) show some degree of ambiguity regarding the a priori expected sign. Event 18 was the publication of the results of the RIO-North America 2-year follow-up clinical trial in JAMA, which were only partially positive (February 15, 2006). After authorization was refused in North America, in June 2007, the advisory committee of the EMA issued a warning on 19th July 2007: event 31 (expected negative sign), but did not withdraw the drug in Europe, unlike what occurred in the USA (expected positive sign).

Event study methodologyAn abnormal return is defined as the component of the return that is not due to systematic influences (market-wide influences). In other words, the abnormal return is the difference between the actual return and what is expected to result from market movements (normal return).

This methodology, with its many extensions, has become an important tool in finance and economics.25–29 In the present study, we followed the methodology defined by MacKinlay.29 Firstly, we estimated the market model for each security (Sanofi-Aventis, Abbott, Roche) for the estimation window, defined as 300 trading days. The abnormal return was calculated for each stock as the daily prediction error for the event window, defined as ±5 days around the critical date. Critical dates are the 46 event dates displayed in table 3. Tests were also carried out with shorter windows (±2 days), while longer windows (±21 days) were discarded because they might lead to overlapping among some events. Once the individual abnormal returns were obtained, they were aggregated in the interval defined by the event window to obtain the cumulative abnormal returns (CAR) for each stock (i.e., CAR(-5.0) represents the cumulated effect from 5 days before the event date to the event day). The t-statistic was used to test the hypothesis that a CAR is statistically different from zero (two-tailed test). We also calculated the change in the market value of the company on the NYSE by using the expression proposed by Dowdell et al30 and performed additional robustness checks, i.e., by excluding both Sanofi-Aventis and Abbott and Roche from the index, because the attenuation bias might also affect the estimates of the competitors.31

We analyzed spillover effects on the stock returns of Abbott and Roche, which are direct competitors, as well as on the firms competing in the innovation race for new antiobesity drugs since 2007, such as Pfizer and Merck & Co.

ResultsThe impact of R&D news on pharmaceutical firms’ stock valuesSignificant market response effects were detected for only 8 of the 46 events (numbers 18-20, 29, 33, 42, 45 and 46 in table 3). Of these events, three were positive and five were negative. These events constituted three pairs of consecutive, related events, and all occurred during the period 2006-2008. The robustness analysis showed no significant changes. Detailed results of the estimated models are available as Annex in this article on line.

The significant events were the following:

- 1)

Reuters reported that the FDA rejected the use of rimonabant for smoking cessation (February 17, 2006). The official letter from de FDA to Sanofi was sent 5 days later, on February 22. The market reacted significantly that day (February 22, CAR−5,+2=−6%). Neither filtration of the news, nor the publication in JAMA32 2 days before of worse-than-expected partial results of the RIO-North America clinical trial had any impact. Only the FDA official letter disclosure had an effect. The FDA's decision may well have been based on the news published in JAMA on February 15. The fall in the market value of the company was around $3.8m.

- 2)

At the 55th scientific session of the American College of Cardiology, on March 12, 2006, good results were presented on the use of rimonabant in abdominal obesity (review of phase III clinical trials), along with data from the general practice-based IDEA (International Day for the Evaluation of Abdominal Obesity). The market reacted with a CAR(-5.0) = 7%, and the market valuation of the company increased by $1.6m.

- 3)

The FDA advisory committee refused to approve the drug (June 11, 2007). This event produced significant negative effects in the CAR from the event date to 5 days later. On the event day there was a drop of around 4%, significant at 10%. The maximum drop in the market value of the company ($15.88 m) occurred on event day +3, and was the largest decrease in the total set of studied events. The total accumulated drop in the event window was 13%, which was significant at 1% (the t-statistic was equal to -3.94). In June 2007, the stock valuation of Sanofi-Aventis at the NYSE fell from $48 to $40 (in Europe, from 71 to 60 Euros).

- 4)

The EMA published a safety warning on the adverse psychiatric effects of the drug (July 19, 2007). The EMA advisory committee warned of problems of depression affecting patients taking this drug, although it continued to be commercialized.

- 5)

On November 13, 2007, the European Commission endorsed the positive opinion to extend the summary of product characteristics for rimonabant. The market anticipated the good news, reacting positively from 5 days earlier, with CAR varying from CAR−5,−5=3% to CAR(-5.0)=7%, both statistically significant at 1%.

- 6)

On June 9, 2008 the final update of the RIO-Diabetes trial was disclosed. Its poor results affected the market prices on the same and the next day, with a CAR−5,+1=−6%. The fall in the market value of Sanofi-Aventis was nevertheless small (-$0.67 m on June 9, 2008).

- 7)

Rimonabant was withdrawn (October 23, 2008). On day 0 there was a positive effect significant at 10%; nonsignificant effects in the next 2 days, and a large positive CAR on days +3 and +4, reaching 14% on October 29 (day +4).

- 8)

All trials with rimonabant were suspended (November 5, 2008). The accumulated fall in value reached 9% the day after the event, significant at 5%.

Neither scientific announcements nor regulatory decisions had spillover effects on the manufacturers of substitute products.

DiscussionOnly eight of the 46 events in the rimonabant story had effects on the stock returns of the company; six of them were related to regulatory decisions, only two corresponded to clinical trial news, and five were negative.

The publication of the results of clinical trials in scientific journals had no significant effects, with a few exceptions. The events found to be significant corresponded to decisions by the regulatory authority (to withdraw from the market) or by the company itself (to suspend all trials with the drug). The positive effects on the market of the safety warning issued by the EMA on rimonabant (July 19, 2007) can be attributed to investors’ fearing that the drug would be withdrawn from the market following the USA's refusal to authorise it the previous month (June 11, 2007), where CAR is negative.

Rimonabant's withdrawal (October 23, 2008) apparently had a positive effect on Sanofi-Aventis. This very surprising result could be due to market anticipation of the withdrawal and might reflect a reaction to other good news for the company, specifically, the approval by the FDA of a new treatment for children with diabetes on October 29.33

In general, the effects were immediate, or there was a lag of at most 1 day following an event. Adjustments thus seem to be rapid, which is consistent with the efficient market hypothesis. Nevertheless, the market did not discount the information on scientific discoveries until the regulator reacted with a concrete decision, suggesting that investors are unable to foresee the consequences of some scientific news items and do not adjust their expectations correctly, as was the case, for example, in February 2006. In this context, the growing interest in Wall Street in hiring doctors as investment advisors and as scientific translators is understandable.3,4,34 However, these results contrast with the literature showing that scientific information matters for physicians’ prescription choices.35 Our results show that there is a missing link between scientific information and market valuation. In this sense, the markets are not performing well in aggregating information. The unique scientific event (the 55th scientific session of the American College of Cardiology), which had significant impacts on returns, was similar to the other scientific news in the way it was released to the media and spread by press agencies. We tracked every event in Factiva: how many times and which press media echoed the event. We conclude what has an impact on marked valuations is the type of information (regulatory or scientific) rather than the way it is communicated to the press.

Another study using event study methodology36 found no significant effects, or at most only a weak level of significance, of the meetings of the FDA advisory committee on the stock valuations of pharmaceutical companies. The authors interpreted this as a sign of market efficiency. In our case, while the clinical trials do not seem to have surprised the stock exchange, regulatory decisions had a significant impact. No positive scientific news item had a significant effect on stock values; the first promising results of the pre-clinical stage, the clinical trials (from 2002-2006), the authorization for the product to be commercialized in Europe and in other countries, and its recommendation in the NICE guidelines had no significant impact. The stock market had already discounted these expectations of success. As in other studies on the pharmaceutical market,37 when using Filson's model we found that the negative effects of bad news were more intense than the positive effects.38 Failures have a greater impact on stock values than do the successes of discovery.

Models of innovation or technological races usually assume that due to patents, experience economies or marketing strategies, the first firm to introduce a new product or process reaps disproportionate profits relative to imitators or follow-on innovators.39,40 Therefore, each firm is anxious to finish the development of a new product or process in first position relative to competitors (hence the term “race” associated with the literature on the topic) and is ready to make the necessary investments and decisions to that end. In our case, three companies were involved around 2007 in the “obesity pill race” against Sanofi-Aventis: Pfizer (drug CP-945598), Merck & Co. (taranabant) and Alizyme (cetilistat). Our aim was not to measure spillovers in this prospective race, but to measure spillover effects on incumbent drug marketers. Therefore, in this study we analyzed the market reactions of Sanofi-Aventis and of the two companies that marketed antiobesity drugs before rimonabant was approved. Those incumbent drugs had low efficacy for weight reduction. We found no empirical evidence of any spillover effects. There was no contagion effect of bad news concerning rimonabant on its competitors. Such an effect would be expected if there were a “systemic concern for the safety of similar drugs or expectation of higher regulatory costs”.9 Equally, we found no evidence of a competitive effect, as would be expected if there were an oligopoly such that when one firm withdraws a product, its competitors gain market share and enjoy abnormal positive returns.

One limitation of our study is that Sanofi-Aventis is a large company and its stock value depends on many other drugs in its portfolio and in the pipeline. Rimonabant constituted a modest proportion of the company's total sales, although by 2008 some 400,000 people in 25 countries had taken the treatment. The lack of significant effects on the stock valuations of Roche or Abbott may also have been due to the large size of both these companies, in which antiobesity drugs represent only a small proportion of total sales.

The market's expectations of a new antiobesity drug depend on many complex factors regarding the institutional context, including the scope of public policies and the support for the latter from the general population,12 as well as factors related to manufacturers, markets and the sector. We cannot account for everything, but in the present study we have opened up a promising new line of research in the area of healthcare economics.

The valuation of pharmaceutical companies in the stock market is affected by scientific and regulatory events that concern the company itself and the competition. Generally, negative news has a stronger impact than positive news.

What this study contributesRegulatory decisions about medicines to treat obesity exert more influence on the stock market than scientific news. There are no contagion effects in the market for obesity drugs. Scientific and regulatory events concerning a drug do not significantly change the market valuations of competing companies.

Both authors contributed substantially to the conception and design of the study, data acquisition, analysis and interpretation of data, and drafting of the article. Both authors have approved the final version for publication.

FundingFinancial support from the Spanish Ministry of Science and Technology (SEJ2006-07701/ECON) and an unconditional grant from the Merck Foundation to the CRES, University Pompeu Fabra, Spain.

Conflict of interestsNone.

The authors are grateful to Salvador Torra (University of Barcelona) for kindly providing the data and also to the seminar participants at the 29th Meeting on Health Economics held in Málaga (Spain) for comments and suggestions on an earlier version of this paper.